Question: I don't know how to do the question 3 and 4. MarTsunkaya company uses a job order cost system. The company uses predetermined overhead rates,

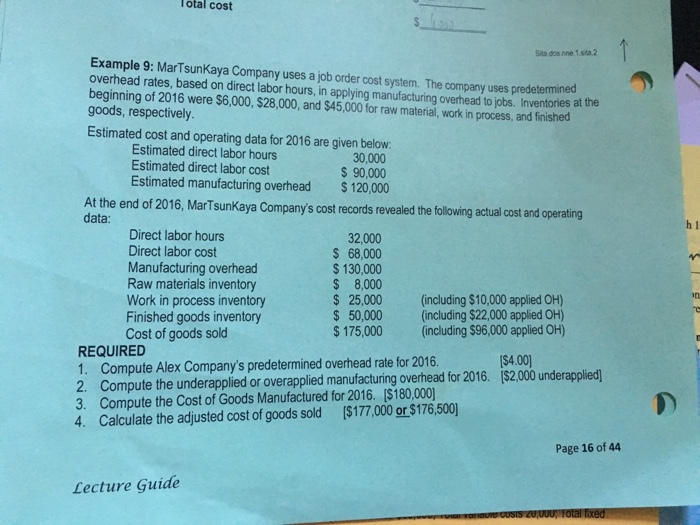

MarTsunkaya company uses a job order cost system. The company uses predetermined overhead rates, based on direct labor hours, in applying manufacturing overhead to jobs. Inventories at the beginning of 2016 were $6,000, $28,000, and $45,000 for raw material, work in process, and finished goods, respectively. Estimated cost and operating data for 2016 are given below: Estimated direct labor hours 30,000 Estimated direct labor cost $ 90,000 Estimated manufacturing overhead overhead $ 120,000 At the end of 2016, MarTsunKaya Company's cost records revealed the following actual cost and operating data: Direct labor hours 32,000 Direct labor cost $ 68,00 Manufacturing overhead $ 130,000 Raw materials inventory $ 8,000 Work in process inventory $ 25,000 (including $10,000 applied OH) Finished goods inventory $ 50,000 (including $22,000 applied OH) Cost of goods sold $ 175,000 (including $96,000 applied OH) Compute Alex Company's predetermined overhead rate for 2016. [$4.00] Compute the underapplied or overapplied manufacturing overhead for 2016. [$2,000 underapplied] compute the cost of goods manufactured for 2016. [$180,000] Calculate the adjusted cost of goods sold [$177,000 or $176, 500]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts