Question: I don't know if this helps but.. Problem 19-41 (LO. 6) Gabriella, age 34, and Beth, age 32, have been married for nine years. Gabriella,

I don't know if this helps but..

I don't know if this helps but..

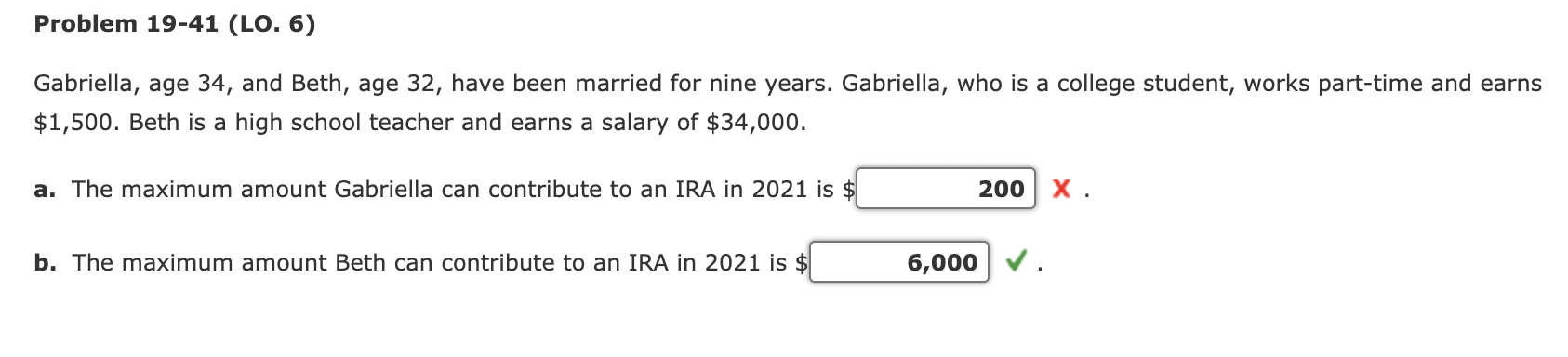

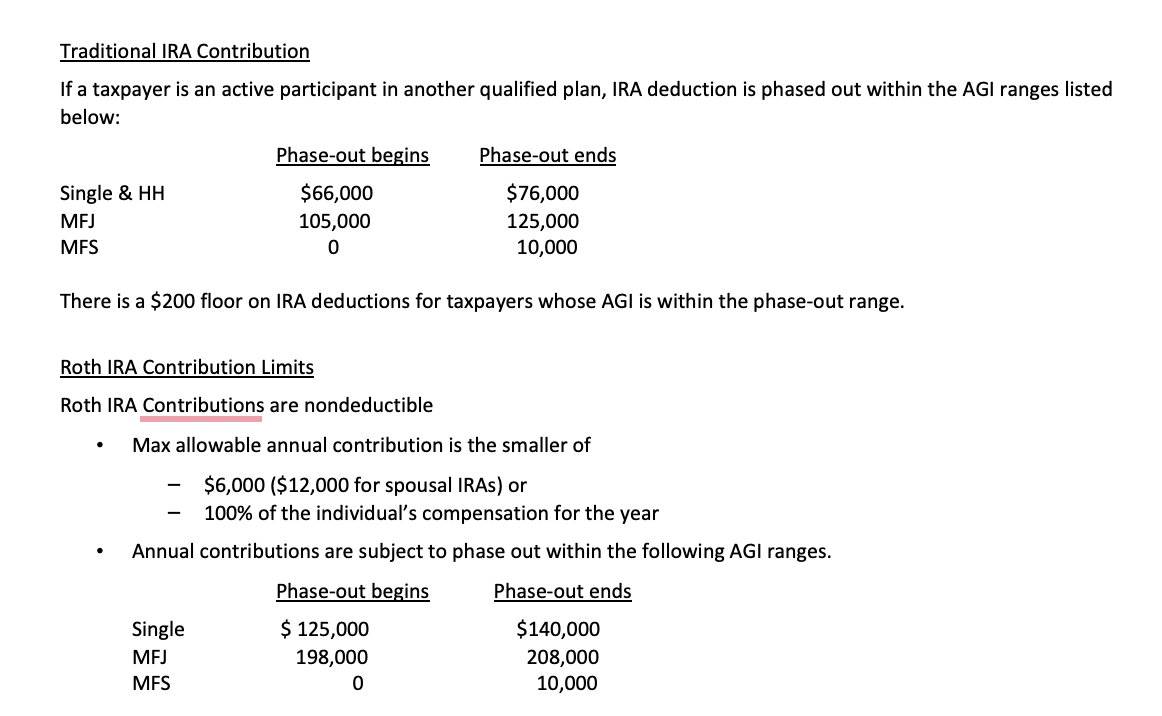

Problem 19-41 (LO. 6) Gabriella, age 34, and Beth, age 32, have been married for nine years. Gabriella, who is a college student, works part-time and earns $1,500. Beth is a high school teacher and earns a salary of $34,000. a. The maximum amount Gabriella can contribute to an IRA in 2021 is $ 200 X. b. The maximum amount Beth can contribute to an IRA in 2021 is $ 6,000 Traditional IRA Contribution If a taxpayer is an active participant in another qualified plan, IRA deduction is phased out within the AGI ranges listed below: Phase-out ends Single & HH MFJ MFS Phase-out begins $66,000 105,000 0 $76,000 125,000 10,000 There is a $200 floor on IRA deductions for taxpayers whose AGI is within the phase-out range. Roth IRA Contribution Limits Roth IRA Contributions are nondeductible . Max allowable annual contribution is the smaller of - . $6,000 ($12,000 for spousal IRAs) or 100% of the individual's compensation for the year Annual contributions are subject to phase out within the following AGI ranges. Phase-out begins Phase-out ends Single $ 125,000 $140,000 MFJ 198,000 208,000 MFS 0 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts