Question: I don't know the formulas to enter in the spreadsheet, if you could post an excel document that would be great. questions one and two

I don't know the formulas to enter in the spreadsheet, if you could post an excel document that would be great. questions one and two should match the two excel spreadsheets

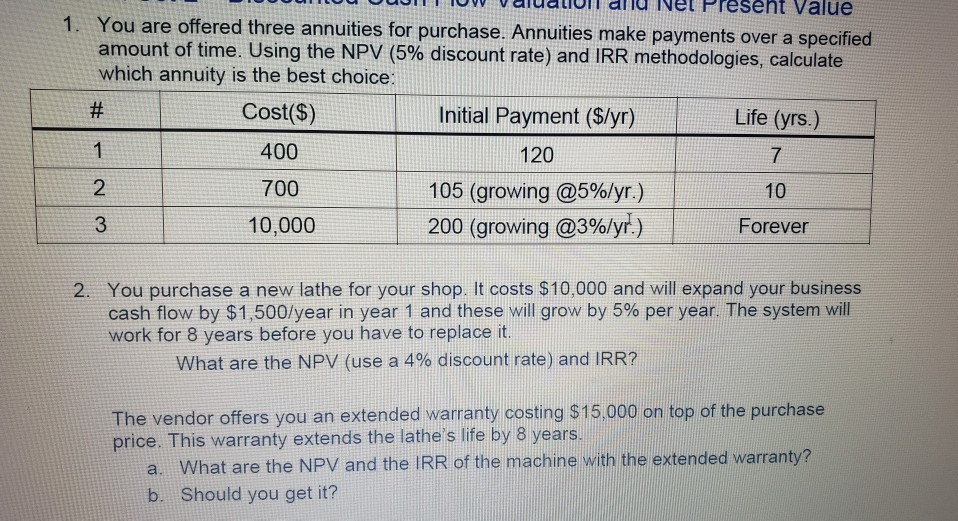

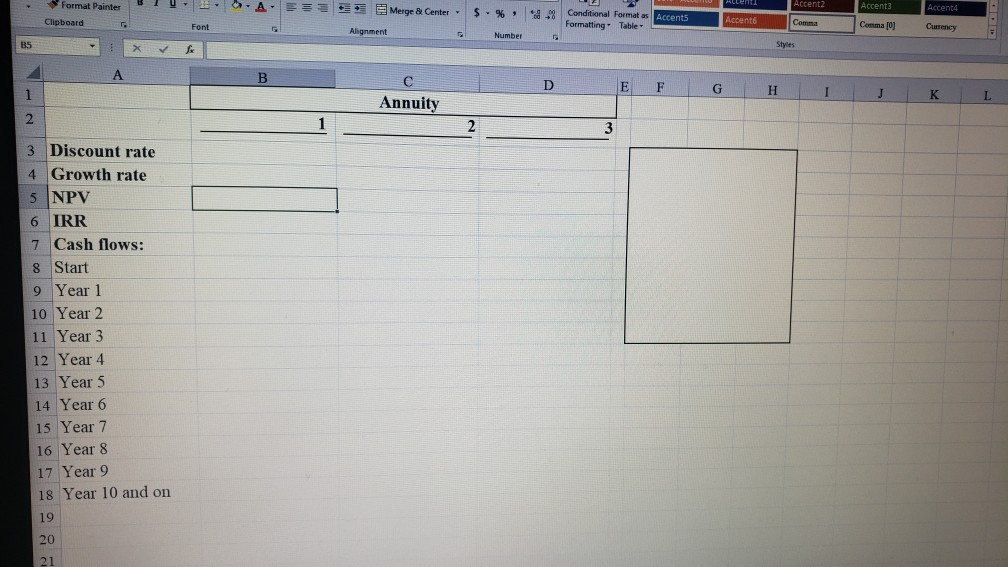

Value 1. You are offered three annuities for purchase. Annuities make payments over a specified amount of time. Using the NPV (5% discount rate) and IRR methodologies, calculate which annuity is the best choice: # Cost($) Initial Payment ($/yr) Life (yrs.) 1 400 120 7 700 105 (growing @5%/yr.) 10 3 10,000 200 (growing @3%/yr.) Forever 1 2 2. You purchase a new lathe for your shop. It costs $10,000 and will expand your business cash flow by $1,500/year in year 1 and these will grow by 5% per year. The system will work for 8 years before you have to replace it. What are the NPV (use a 4% discount rate) and IRR? The vendor offers you an extended warranty costing $15,000 on top of the purchase price. This warranty extends the lathe's life by 8 years. What are the NPV and the IRR of the machine with the extended warranty? b Should you get it? a. MELEN Accent2 Accent3 Accent4 Format Painter Clipboard 5.A. Merge & Center Alignment $ % 8-98 Conditional Format as Accents Formatting Table Accento Comma Font Comma] Currency Number B5 Styles A B D E F G 1 H J K L Annuity 2 2 3 3 Discount rate 4 Growth rate 5 NPV 6 IRR 7 Cash flows: 8 Start 9 Year 1 10 Year 2 11 Year 3 12 Year 4 13 Year 5 14 Year 6 15 Year 7 16 Year 8 17 Year 9 18 Year 10 and on 19 20 21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts