Question: I dont know the last three. How do i do it? Navy Surplus began July 2018 with 80 stoves that cost $10 each. During the

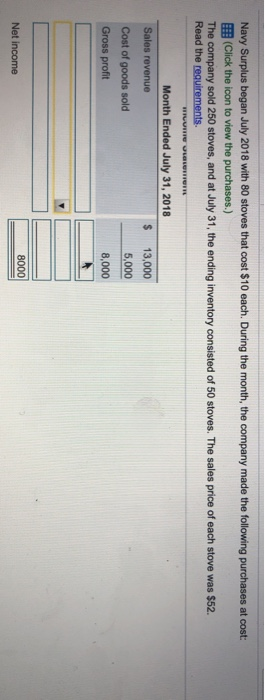

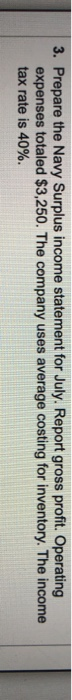

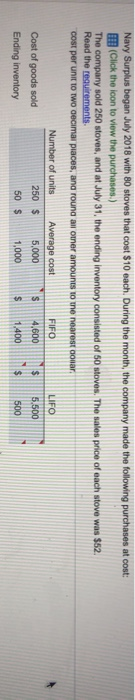

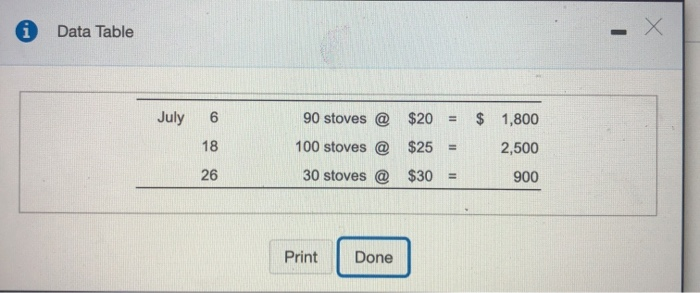

Navy Surplus began July 2018 with 80 stoves that cost $10 each. During the month, the company made the following purchases at cost: (Click the icon to view the purchases.) The company sold 250 stoves, and at July 31, the ending inventory consisted of 50 stoves. The sales price of each stove was $52. Read the requirements. WELL Month Ended July 31, 2018 Sales revenue $ 13,000 Cost of goods sold 5,000 Gross profit 8,000 Net income 8000 3. Prepare the Navy Surplus income statement for July. Report gross profit. Operating expenses totaled $3,250. The company uses average costing for inventory. The income tax rate is 40%. Navy Surplus began July 2018 with 80 stoves that cost $10 each. During the month, the company made the following purchases at cost: (Click the icon to view the purchases.) The company sold 250 stoves, and at July 31, the ending inventory consisted of 50 stoves. The sales price of each stove was $52. Read the requirements cost per unit to two decimal places, and round all other amounts to the nearest donar Number of units Average cost FIFO LIFO Cost of goods sold 250 $ 5,000 4,600 5,500 Ending inventory 50 $ 1,000 $ 1.400 500 ves that cost $10 each. During the mo 31, the ending inventory consisted of Accounts payable Accounts receivable Advertising expense T Automobiles F Cost of goods sold Gross profit Income before income taxes Income tax expense Inventory Operating expenses Purchases 13,000 5,000 8,000 8000 Net income * Data Table July 6 $ 90 stoves @ 100 stoves @ 30 stoves @ $20 = $25 = $30 = 1,800 2,500 900 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts