Question: i dont know what im doing wrong On January 1, 2020, Sheridan Company makes the two following acquisitions 1. Purchases and having a fair value

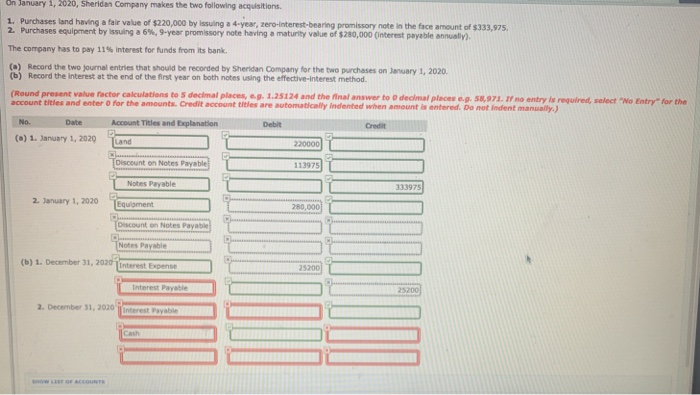

On January 1, 2020, Sheridan Company makes the two following acquisitions 1. Purchases and having a fair value of $220,000 by issuing a 4-year, zero-interest-bearing promissory note in the face amount of $333,975. 2. Purchases equipment by issuing a 6%, 9-year promissory note having a maturity value of $280,000 interest payable annually) The company has to pay 11% Interest for funds from its bank. (a) Record the two journal entries that should be recorded by Sheridan Company for the two purchases on January 1, 2020 (b) Record the interest at the end of the first year on both notes using the effective-interest method. (Round present value factor calculations to decimal places, .g. 1.25124 and the final answer to decimal places .g. 58,971. If no antry is required, select "No Entry for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Date Account Titles and Explanation Debit Credit (a) 1. January 1, 2020 Land 220000 Discount on Notes Payable 113975 Notes Payable 333975 2. January 1, 2020 Equipment 280,000 Discount on Notes Payable Notes Payable (1) 1. December 31, 2020 Interest pense 25200 Interest Payable 25200 2. December 31, 2010 Interest Payable Cash HOW COURS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts