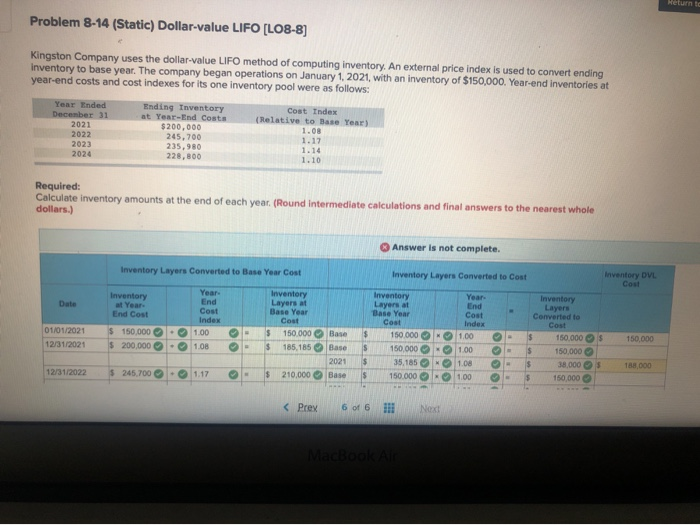

Question: i dont know what im missing. its says incomplete?! Heturn to Problem 8-14 (Static) Dollar-value LIFO [LO8-8] Kingston Company uses the dollar-value LIFO method of

![8-14 (Static) Dollar-value LIFO [LO8-8] Kingston Company uses the dollar-value LIFO method](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e321d70034b_36666e321d63ad9b.jpg)

Heturn to Problem 8-14 (Static) Dollar-value LIFO [LO8-8] Kingston Company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending Inventory to base year. The company began operations on January 1, 2021, with an inventory of $150,000. Year-end Inventories at year-end costs and cost indexes for its one inventory pool were as follows: Cost Index (Relative to Base Year) Year Ended December 31 2021 2022 2023 2024 Ending Inventory at Year-End Costs $ 200,000 245,700 235,980 228,800 Required: Calculate inventory amounts at the end of each year. (Round Intermediate calculations and final answers to the nearest whole dollars.) Answer is not complete. Inventory Layers Converted to Base Year Cost Inventory Layers Converted to Cost Inventory DVL Cost Year Date Inventory al Year End Cost Cost Inventory Layers Converted to Inventory Layers at Base Year Cost 150.000 185 185 01/01/2021 12/31/2021 $ $ 150,000 200,000 1.00 1.08 Inventory Layers at Base Year Cost 150.000 150.000 35,1851 150.000 $ 150.000 - Base Base 2021 Bases - End Cost Index 1.00 1.00 .08 1.00 - - $ 150.000 150,000 38,000S 150,000 188 000 12/31/2022 245.700 - 1.17 - $ 210,000 - $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts