Question: I dont know where i went wrong here....please some help 2-9: Corporate Income Taxes The Talley Corporation had taxable operating income of $375,000 (i.e., earnings

I dont know where i went wrong here....please some help

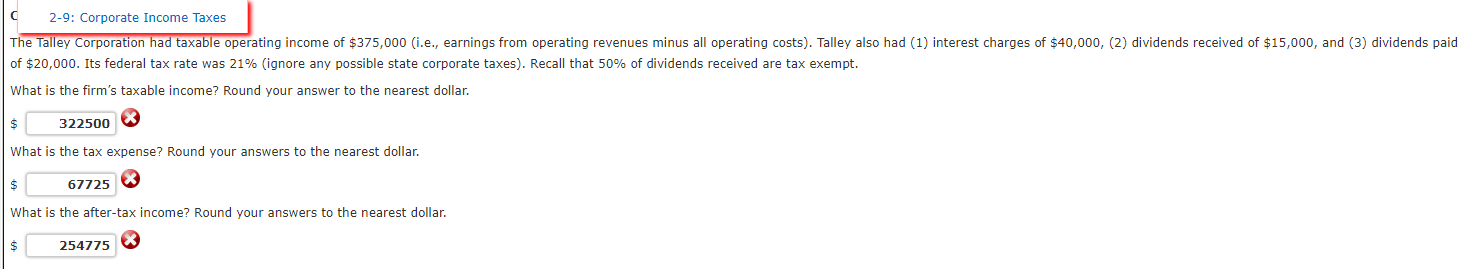

2-9: Corporate Income Taxes The Talley Corporation had taxable operating income of $375,000 (i.e., earnings from operating revenues minus all operating costs). Talley also had (1) interest charges of $40,000, (2) dividends received of $15,000, and (3) dividends paid of $20,000. Its federal tax rate was 21% (ignore any possible state corporate taxes). Recall that 50% of dividends received are tax exempt. What is the firm's taxable income? Round your answer to the nearest dollar. 322500 What is the tax expense? Round your answers to the nearest dollar. $ 67725 What is the after-tax income? Round your answers to the nearest dollar. $ 254775

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts