Question: i dont know why I'm unable go get the answer for B manufacturing overhead Exercise 16.6 (Algo) Flow of Costs through Manufacturing Accounts (LO16-3, LO16-4,

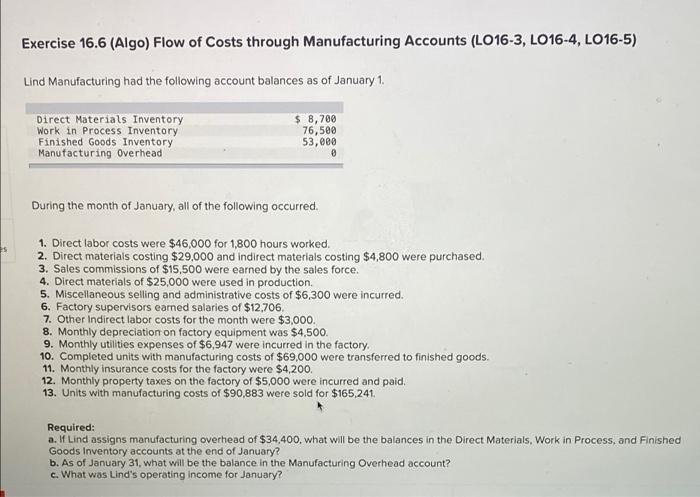

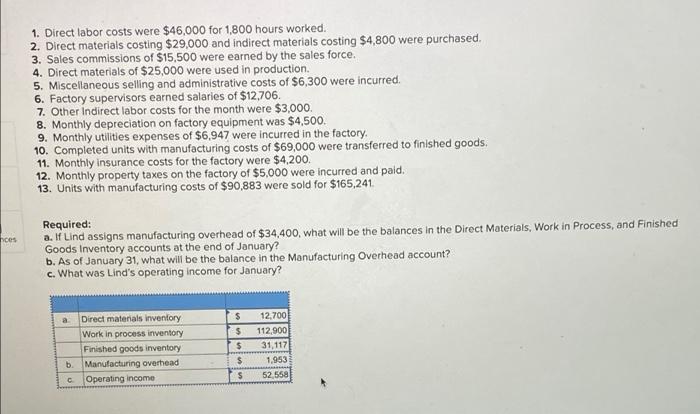

Exercise 16.6 (Algo) Flow of Costs through Manufacturing Accounts (LO16-3, LO16-4, LO16-5) Lind Manufacturing had the following account balances as of January 1. $ 8,700 76,500 Direct Materials Inventory Work in Process Inventory Finished Goods Inventory Manufacturing Overhead 53,000 0 During the month of January, all of the following occurred. 1. Direct labor costs were $46,000 for 1,800 hours worked. s 2. Direct materials costing $29,000 and indirect materials costing $4,800 were purchased. 3. Sales commissions of $15,500 were earned by the sales force. 4. Direct materials of $25,000 were used in production. 5. Miscellaneous selling and administrative costs of $6,300 were incurred. 6. Factory supervisors earned salaries of $12,706. 7. Other Indirect labor costs for the month were $3,000., 8. Monthly depreciation on factory equipment was $4,500. 9. Monthly utilities expenses of $6,947 were incurred in the factory. 10. Completed units with manufacturing costs of $69,000 were transferred to finished goods. 11. Monthly insurance costs for the factory were $4,200. 12. Monthly property taxes on the factory of $5,000 were incurred and paid. 13. Units with manufacturing costs of $90,883 were sold for $165,241. Required: a. If Lind assigns manufacturing overhead of $34,400, what will be the balances in the Direct Materials, Work in Process, and Finished Goods Inventory accounts at the end of January? b. As of January 31, what will be the balance in the Manufacturing Overhead account? c. What was Lind's operating income for January? ces 1. Direct labor costs were $46,000 for 1,800 hours worked. 2. Direct materials costing $29,000 and indirect materials costing $4,800 were purchased. 3. Sales commissions of $15,500 were earned by the sales force. 4. Direct materials of $25,000 were used in production. 5. Miscellaneous selling and administrative costs of $6,300 were incurred. 6. Factory supervisors earned salaries of $12,706. 7. Other Indirect labor costs for the month were $3,000. 8. Monthly depreciation on factory equipment was $4,500. 9. Monthly utilities expenses of $6,947 were incurred in the factory. 10. Completed units with manufacturing costs of $69,000 were transferred to finished goods. 11. Monthly insurance costs for the factory were $4,200. 12. Monthly property taxes on the factory of $5,000 were incurred and paid. 13. Units with manufacturing costs of $90,883 were sold for $165,241. Required: a. If Lind assigns manufacturing overhead of $34,400, what will be Goods Inventory accounts at the end of January? b. As of January 31, what will be the balance in the Manufacturing Overhead account? c. What was Lind's operating income for January? a $ 12,700 $ 112,900 Direct materials inventory Work in process inventory Finished goods inventory: Manufacturing overhead i $ 31,117 1,953 $ Operating income 52,558 b. C $ balances in the Direct Materials, Work in Process, and Finished

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts