Question: I dont need any explanation please solve it like you are in exam, I will give it a like Q4. Initial investment for a project

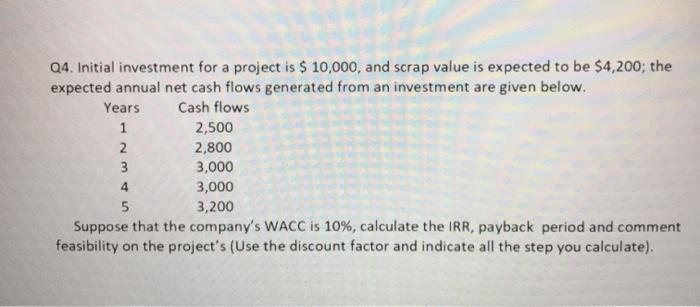

Q4. Initial investment for a project is $ 10,000, and scrap value is expected to be $4,200; the expected annual net cash flows generated from an investment are given below. Years Cash flows 1 2,500 2 2,800 3 3,000 3,000 5 3,200 Suppose that the company's WACC is 10%, calculate the IRR, payback period and comment feasibility on the project's (Use the discount factor and indicate all the step you calculate). 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts