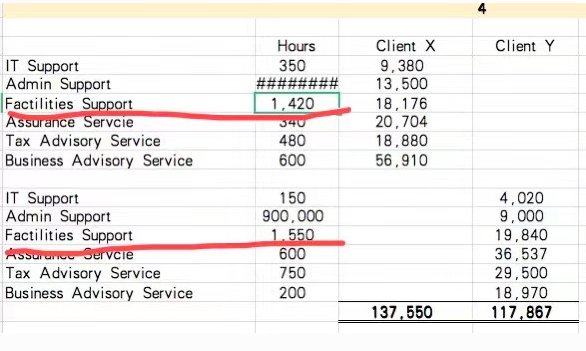

Question: I don't need the answer process. I've attached the answer. I want to know where the facilities support of X and Y in the fourth

I don't need the answer process. I've attached the answer. I want to know where the facilities support of X and Y in the fourth question comes from, 1420 and 1550 respectively?

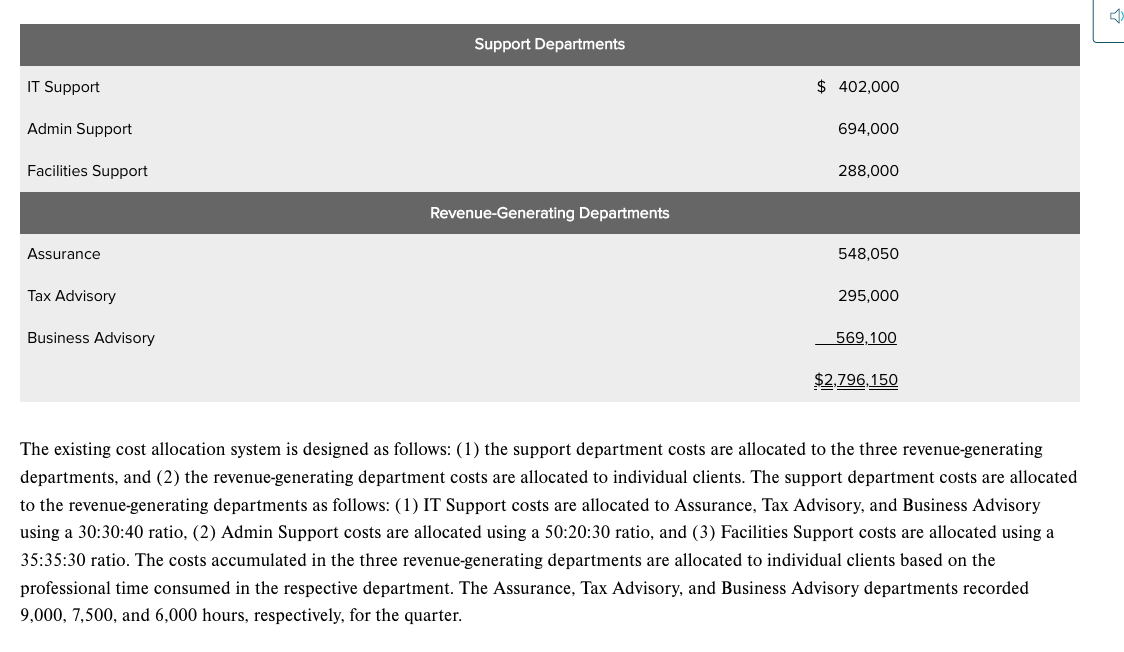

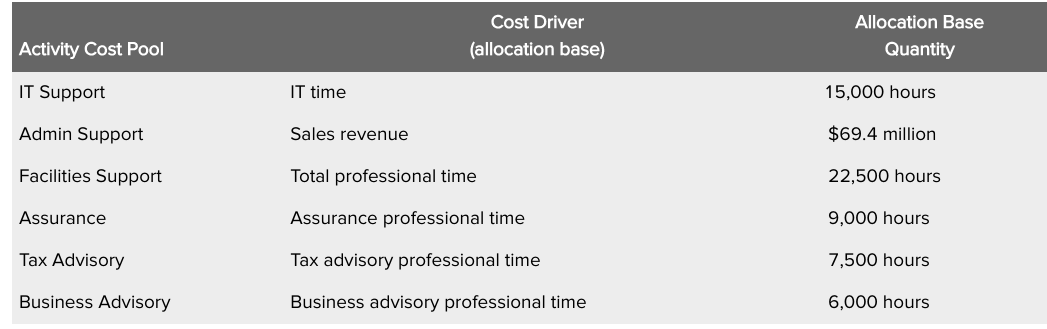

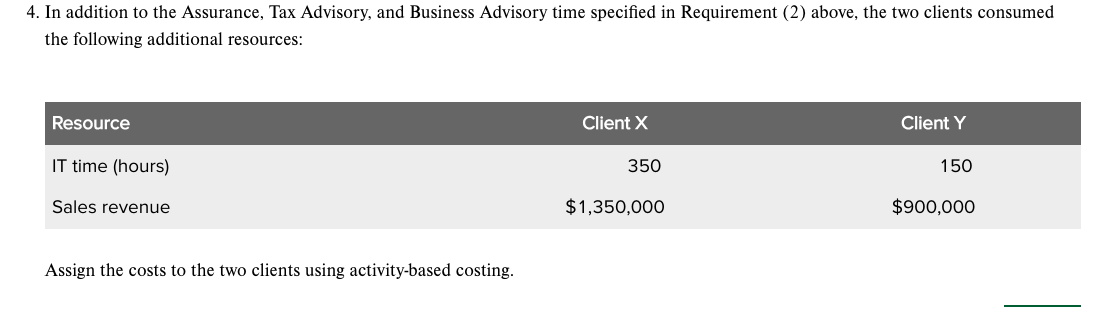

Support Departments IT Support $ 402,000 Admin Support 694,000 Facilities Support 288,000 Revenue-Generating Departments Assurance 548,050 Tax Advisory 295,000 Business Advisory 569,100 $2,796,150 The existing cost allocation system is designed as follows: (1) the support department costs are allocated to the three revenue-generating departments, and (2) the revenue-generating department costs are allocated to individual clients. The support department costs are allocated to the revenue-generating departments as follows: (1) IT Support costs are allocated to Assurance, Tax Advisory, and Business Advisory using a 30:30:40 ratio, (2) Admin Support costs are allocated using a 50:20:30 ratio, and (3) Facilities Support costs are allocated using a 35:35:30 ratio. The costs accumulated in the three revenue-generating departments are allocated to individual clients based on the professional time consumed in the respective department. The Assurance, Tax Advisory, and Business Advisory departments recorded 9,000, 7,500, and 6,000 hours, respectively, for the quarter. Cost Driver (allocation base) Allocation Base Quantity Activity Cost Pool IT Support IT time 15,000 hours Admin Support Sales revenue $69.4 million Facilities Support Total professional time 22,500 hours Assurance Assurance professional time 9,000 hours Tax Advisory Tax advisory professional time 7,500 hours Business Advisory Business advisory professional time 6,000 hours 4. In addition to the Assurance, Tax Advisory, and Business Advisory time specified in Requirement (2) above, the two clients consumed the following additional resources: Resource Client X Client Y IT time (hours) 350 150 Sales revenue $1,350,000 $900,000 Assign the costs to the two clients using activity-based costing. Client Y IT Support Admin Support Factilities Support Assurance Servcie Tax Advisory Service Business Advisory Service Hours 350 ######## 1,420 340 480 600 Client X 9.380 13,500 18,176 20.704 18.880 56.910 IT Support Admin Support Factilities Support Assurance Servcie Tax Advisory Service Business Advisory Service 150 900.000 1.550 600 750 200 4,020 9,000 19.840 36,537 29,500 18,970 117,867 137,550

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts