Question: I don't need the answer to 5 5. If the ending inventory for 2020 is overstated by $10,000, the effects of this error on cost

I don't need the answer to 5

I don't need the answer to 5

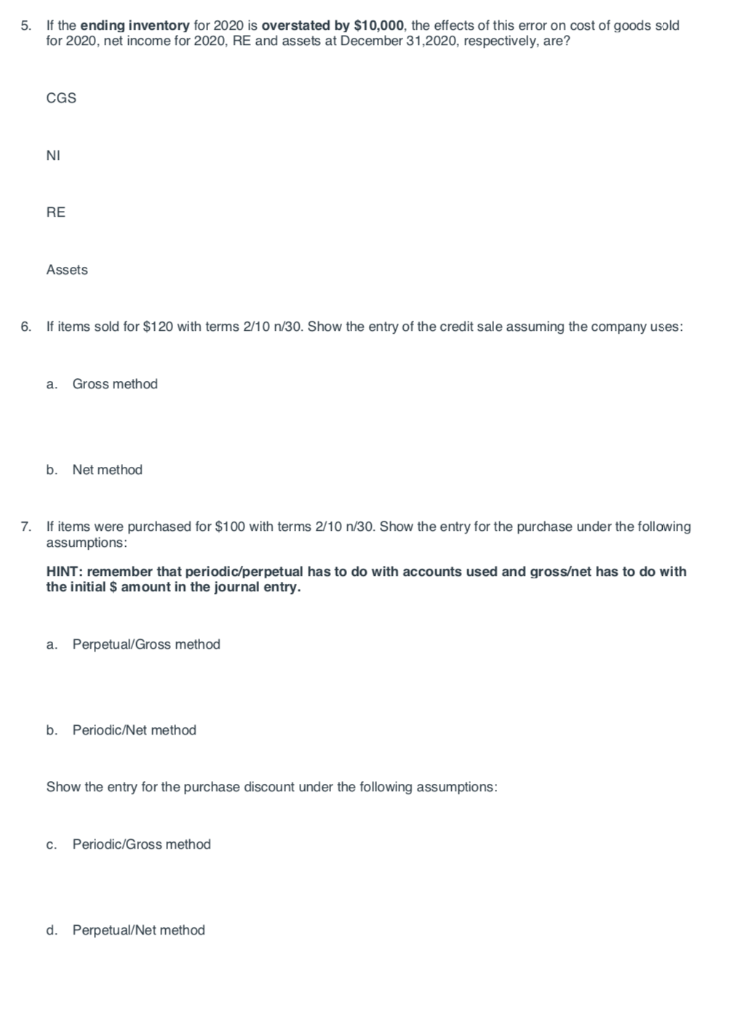

5. If the ending inventory for 2020 is overstated by $10,000, the effects of this error on cost of goods sold for 2020, net income for 2020, RE and assets at December 31,2020, respectively, are? CGS NI RE Assets 6. If items sold for $120 with terms 2/10 n/30. Show the entry of the credit sale assuming the company uses: a Gross method b. Net method 7. If items were purchased for $100 with terms 2/10 n/30. Show the entry for the purchase under the following assumptions: HINT: remember that periodic/perpetual has to do with accounts used and grosset has to do with the initial $ amount in the journal entry. a. Perpetual/Gross method b. Periodic/Net method Show the entry for the purchase discount under the following assumptions: c. Periodic/Gross method d. Perpetual/Net method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts