Question: i dont quite inderstand the instructions given and need help filling out this balance worksheet. need to complete everything inder NET WORTH and CASH WORKSHEET

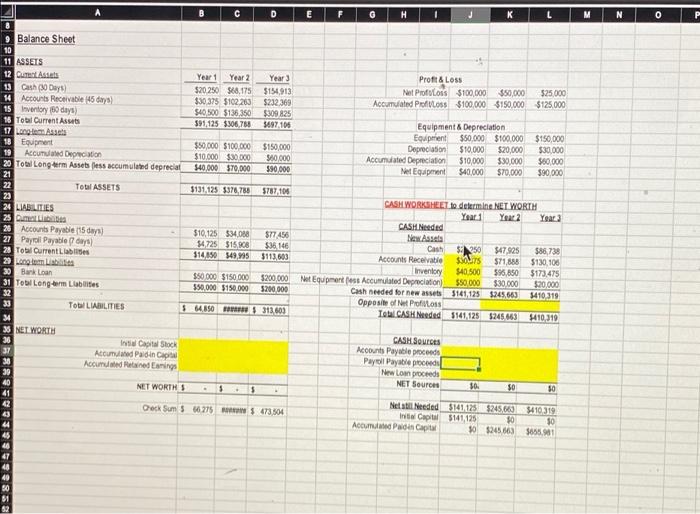

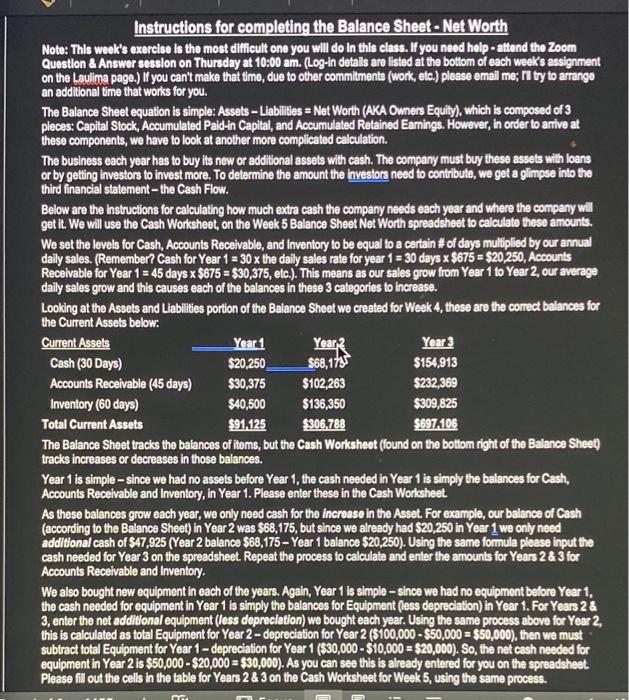

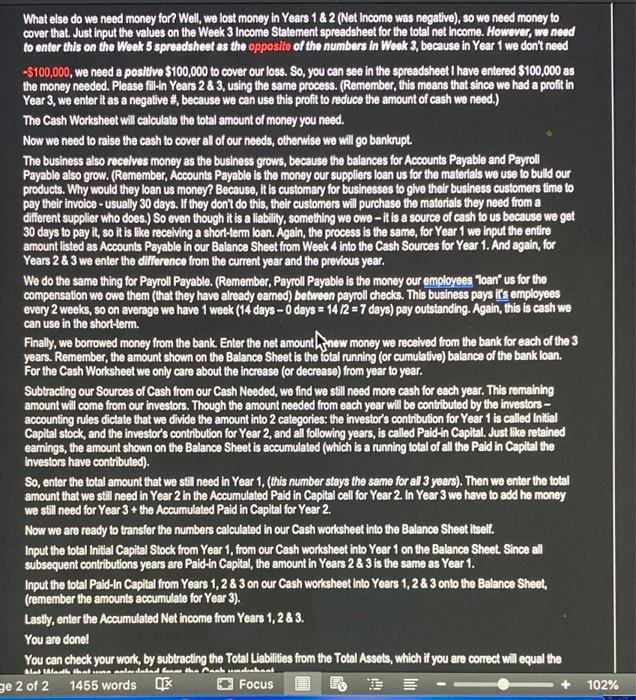

B C D E F G H L M N 0 P 9 Balance Sheet 10 11 ASSETS 12 QUTLA 13 h 30 Days 14 Accounts Receivable 145 days) 15 ventory 150 days) 16 Tobal Current Assets 17 Long Assets 18 Equipment Accued Deonton 20 Total Long-term Assets less accumulated depreciat Year 1 Year 2 $20 250 568,175 $30 375 $102.263 $40.500 5136,350 391,125 $306,760 Year $154,913 $232,369 $309 825 3697,106 Proft & Loss Net ProfLoss $100,000 $50,000 525,000 Accumulated Polloss $100.000 $150,000 $125.000 $50,000 $100.000 $150,000 $10.000 $30.000 560,000 540,000 $70,000 390,000 Equipment & Depreciation Equipient $50,000 $100.000 $150,000 Depreciation $10.000 $20,000 $30,000 Accumulated Depreciation $10,000 $30,000 $60.000 Met Equipment $40,000 $70,000 $90,000 $131 125 3376730 5787104 Total ASSETS 23 24 LIABILITIES 3) 26 Accounts Payable 15 days) 27 Payroll Payablet) 28 Tobil Current Labies 20 Lom Lisboa 30 Bank Loan 31 Tool Long-term Labies $10,125 $34.000 $4.725 15.08 314,050 549,995 $77450 $16.146 $113,603 PERSEROANNARRARAR RRRRR9399599858 CASH WORKSHEET to determine NET WORTH Year 1 Ya 2 Year 3 CASH Needed New Assets Cash 250 $47,925 $86,739 Accounts Receivable $STS $71,888 $130,106 Inventory $40.500 596,850 $173.475 Net Equipment Accumulated Depreciation) 550.000 $30.000 $20,000 Cash needed for new assets 5141,125 5245669 3410 319 Opposite of Net Profits TO CASH Needed 5141.125 $245663 5410,319 $50 000 $150 000 550.000 $150.000 3200.000 5200,000 Total LIABILITIES $ 64850 R$ 313.603 35 NET WORTH In Capital Stock Accumulated Pidin Capital Accured Pined Ering CASH Sources Accounts Payable procede Payo Payable proceeds New Lo proceeds NET Source NET WORTHS $ 30. $0 50 Deck Sums 66275 $ 473,504 Nets Needed 3141125245.63 in Capital 5141,125 $0 Acum Pada Capital 105245.663 3410319 30 $65.91 Instructions for completing the Balance Sheet - Net Worth Note: This week's exercise is the most difficult one you will do in this class. If you need help-attend the Zoom Question & Answer session on Thursday at 10:00 am. (Log-in details are listed at the bottom of each week's assignment on the Laulima page.) If you can't make that time, due to other commitments (work, etc.) please email me; I try to arrange an additional time that works for you. The Balance Sheet equation is simple: Assets - Liabilities = Net Worth (AKA Owners Equity), which is composed of 3 pieces: Capital Stock, Accumulated Paid-in Capital, and Accumulated Retained Earnings. However, in order to arrive at these components, we have to look at another more complicated calculation. The business each year has to buy its new or additional assets with cash. The company must buy these assets with loans or by getting investors to invest more. To determine the amount the investors need to contribute, we get a glimpse into the third financial statement - the Cash Flow. Below are the instructions for calculating how much extra cash the company needs each year and where the company will get it. We will use the Cash Worksheet, on the Week 5 Balance Sheet Net Worth spreadsheet to calculate these amounts. We set the levels for Cash, Accounts Receivable, and Inventory to be equal to a certain # of days multiplied by our annual daily sales. (Remember? Cash for Year 1 = 30 x the daily sales rate for year 1 = 30 days x $675 = $20,250, Accounts Receivable for Year 1 = 45 days x $675 = $30,375, etc.). This means as our sales grow from Year 1 to Year 2, our average daily sales grow and this causes each of the balances in these 3 categories to increase. Looking at the Assets and Liabilities portion of the Balance Sheet we created for Week 4, these are the correct balances for the Current Assets below: Current Assets Year 1 Year2 Year 3 Cash (30 Days) $20,250 $68,175 $154,913 Accounts Receivable (45 days) $30,375 $102,263 $232,369 Inventory (60 days) $40,500 $136,350 $309,825 Total Current Assets $91,125 $306,788 $697.106 The Balance Sheet tracks the balances of items, but the Cash Worksheet (found on the bottom right of the Balance Sheet) tracks increases or decreases in those balances. Year 1 is simple - since we had no assets before Year 1, the cash needed in Year 1 is simply the balances for Cash, Accounts Receivable and Inventory, in Year 1. Please enter these in the Cash Worksheet As these balances grow each year, we only need cash for the increase in the Asset. For example, our balance of Cash (according to the Balance Sheet) in Year 2 was $68,175, but since we already had $20,250 in Year 1 we only need additional cash of $47,925 (Year 2 balance $68,175 - Year 1 balance $20,250). Using the same formula please input the cash needed for Year 3 on the spreadsheet. Repeat the process to calculate and enter the amounts for Years 2 & 3 for Accounts Receivable and Inventory. We also bought new equipment in each of the years. Again, Year 1 is simple - since we had no equipment before Year 1, the cash needed for equipment in Year 1 is simply the balances for Equipment (less depreciation) in Year 1. For Years 2 & 3, enter the net additional equipment (less depreciation) we bought each year. Using the same process above for Year 2, this is calculated as total Equipment for Year 2-depreciation for Year 2 ($100,000 - $50,000 = $50,000), then we must subtract total Equipment for Year 1 - depreciation for Year 1 ($30,000 - $10,000 = $20,000). So, the net cash needed for equipment in Year 2 is $50,000 - $20,000 = $30,000). As you can see this is already entered for you on the spreadsheet Please fill out the cells in the table for Years 2 & 3 on the Cash Worksheet for Week 5, using the same process. - What else do we need money for? Well, we lost money in Years 1 & 2 (Net Income was negative), so we need money to cover that. Just input the values on the Week 3 Income Statement spreadsheet for the total net income. However, we need to enter this on the Week 5 spreadsheet as the opposite of the numbers in Week 3, because in Year 1 we don't need -S100,000, we need a positive $100,000 to cover our loss. So, you can see in the spreadsheet I have entered $100,000 as the money needed. Please fill-in Years 2 & 3, using the same process. (Remember, this means that since we had a profit in Year 3, we enter it as a negative #, because we can use this profit to reduce the amount of cash we need.) The Cash Worksheet will calculate the total amount of money you need. Now we need to raise the cash to cover all of our needs, otherwise we will go bankrupt The business also receives money as the business grows, because the balances for Accounts Payable and Payroll Payable also grow. (Remember, Accounts Payable is the money our suppliers loan us for the materials we use to build our products. Why would they loan us money? Because, it is customary for businesses to give their business customers time to pay their involce - usually 30 days. If they don't do this, their customers will purchase the materials they need from a different supplier who does.) So even though it is a liability, something we owe it is a source of cash to us because we get 30 days to pay it, so it is like receiving a short-term loan. Again, the process is the same, for Year 1 we input the entire amount listed as Accounts Payable in our Balance Sheet from Week 4 into the Cash Sources for Year 1. And again, for Years 2 & 3 we enter the difference from the current year and the previous year. We do the same thing for Payroll Payable. (Remember, Payroll Payable is the money our employees Toan" us for the compensation we owe them (that they have already earned) between payroll checks. This business pays it's employees every 2 weeks, so on average we have 1 week (14 days - 6 days = 14 12 = 7 days) pay outstanding. Again, this is cash we can use in the short-term. Finally, we borrowed money from the bank. Enter the net amount hi new money we received from the bank for each of the 3 years. Remember, the amount shown on the Balance Sheet is the total running (or cumulative) balance of the bank loan. For the Cash Worksheet we only care about the increase for decrease) from year to year. Subtracting our Sources of Cash from our Cash Needed, we find we still need more cash for each year. This remaining amount will come from our investors. Though the amount needed from each year will be contributed by the investors - accounting rules dictate that we divide the amount into 2 categories: the investor's contribution for Year 1 is called Initial Capital stock, and the investor's contribution for Year 2, and all following years, is called Paid-in Capital. Just like retained earnings, the amount shown on the Balance Sheet is accumulated (which is a running total of all the Pald in Capital the investors have contributed). So, enter the total amount that we still need in Year 1, (this number stays the same for all 3 years). Then we enter the total amount that we still need In Year 2 in the Accumulated Paid in Capital cell for Year 2. In Year 3 we have to add he money we still need for Year 3 + the Accumulated Paid in Capital for Year 2. Now we are ready to transfer the numbers calculated in our Cash worksheet into the Balance Sheet itself. Input the total Initial Capital Stock from Year 1, from our Cash worksheet into Year 1 on the Balance Sheet. Since all subsequent contributions years are Paid-in Capital, the amount in Years 2 & 3 is the same as Year 1. Input the total Paid-In Capital from Years 1, 2 & 3 on our Cash worksheet into Years 1, 2 & 3 onto the Balance Sheet, (remember the amounts accumulate for Year 3). Lastly, enter the Accumulated Net income from Years 1, 2 & 3. You are donel You can check your work, by subtracting the Total Liabilities from the Total Assets, which if you are correct will equal the ge 2 of 2 1455 words QE Focus Llah Ala - Ahah tran mani alla - Ah the latest + 102% B C D E F G H L M N 0 P 9 Balance Sheet 10 11 ASSETS 12 QUTLA 13 h 30 Days 14 Accounts Receivable 145 days) 15 ventory 150 days) 16 Tobal Current Assets 17 Long Assets 18 Equipment Accued Deonton 20 Total Long-term Assets less accumulated depreciat Year 1 Year 2 $20 250 568,175 $30 375 $102.263 $40.500 5136,350 391,125 $306,760 Year $154,913 $232,369 $309 825 3697,106 Proft & Loss Net ProfLoss $100,000 $50,000 525,000 Accumulated Polloss $100.000 $150,000 $125.000 $50,000 $100.000 $150,000 $10.000 $30.000 560,000 540,000 $70,000 390,000 Equipment & Depreciation Equipient $50,000 $100.000 $150,000 Depreciation $10.000 $20,000 $30,000 Accumulated Depreciation $10,000 $30,000 $60.000 Met Equipment $40,000 $70,000 $90,000 $131 125 3376730 5787104 Total ASSETS 23 24 LIABILITIES 3) 26 Accounts Payable 15 days) 27 Payroll Payablet) 28 Tobil Current Labies 20 Lom Lisboa 30 Bank Loan 31 Tool Long-term Labies $10,125 $34.000 $4.725 15.08 314,050 549,995 $77450 $16.146 $113,603 PERSEROANNARRARAR RRRRR9399599858 CASH WORKSHEET to determine NET WORTH Year 1 Ya 2 Year 3 CASH Needed New Assets Cash 250 $47,925 $86,739 Accounts Receivable $STS $71,888 $130,106 Inventory $40.500 596,850 $173.475 Net Equipment Accumulated Depreciation) 550.000 $30.000 $20,000 Cash needed for new assets 5141,125 5245669 3410 319 Opposite of Net Profits TO CASH Needed 5141.125 $245663 5410,319 $50 000 $150 000 550.000 $150.000 3200.000 5200,000 Total LIABILITIES $ 64850 R$ 313.603 35 NET WORTH In Capital Stock Accumulated Pidin Capital Accured Pined Ering CASH Sources Accounts Payable procede Payo Payable proceeds New Lo proceeds NET Source NET WORTHS $ 30. $0 50 Deck Sums 66275 $ 473,504 Nets Needed 3141125245.63 in Capital 5141,125 $0 Acum Pada Capital 105245.663 3410319 30 $65.91 Instructions for completing the Balance Sheet - Net Worth Note: This week's exercise is the most difficult one you will do in this class. If you need help-attend the Zoom Question & Answer session on Thursday at 10:00 am. (Log-in details are listed at the bottom of each week's assignment on the Laulima page.) If you can't make that time, due to other commitments (work, etc.) please email me; I try to arrange an additional time that works for you. The Balance Sheet equation is simple: Assets - Liabilities = Net Worth (AKA Owners Equity), which is composed of 3 pieces: Capital Stock, Accumulated Paid-in Capital, and Accumulated Retained Earnings. However, in order to arrive at these components, we have to look at another more complicated calculation. The business each year has to buy its new or additional assets with cash. The company must buy these assets with loans or by getting investors to invest more. To determine the amount the investors need to contribute, we get a glimpse into the third financial statement - the Cash Flow. Below are the instructions for calculating how much extra cash the company needs each year and where the company will get it. We will use the Cash Worksheet, on the Week 5 Balance Sheet Net Worth spreadsheet to calculate these amounts. We set the levels for Cash, Accounts Receivable, and Inventory to be equal to a certain # of days multiplied by our annual daily sales. (Remember? Cash for Year 1 = 30 x the daily sales rate for year 1 = 30 days x $675 = $20,250, Accounts Receivable for Year 1 = 45 days x $675 = $30,375, etc.). This means as our sales grow from Year 1 to Year 2, our average daily sales grow and this causes each of the balances in these 3 categories to increase. Looking at the Assets and Liabilities portion of the Balance Sheet we created for Week 4, these are the correct balances for the Current Assets below: Current Assets Year 1 Year2 Year 3 Cash (30 Days) $20,250 $68,175 $154,913 Accounts Receivable (45 days) $30,375 $102,263 $232,369 Inventory (60 days) $40,500 $136,350 $309,825 Total Current Assets $91,125 $306,788 $697.106 The Balance Sheet tracks the balances of items, but the Cash Worksheet (found on the bottom right of the Balance Sheet) tracks increases or decreases in those balances. Year 1 is simple - since we had no assets before Year 1, the cash needed in Year 1 is simply the balances for Cash, Accounts Receivable and Inventory, in Year 1. Please enter these in the Cash Worksheet As these balances grow each year, we only need cash for the increase in the Asset. For example, our balance of Cash (according to the Balance Sheet) in Year 2 was $68,175, but since we already had $20,250 in Year 1 we only need additional cash of $47,925 (Year 2 balance $68,175 - Year 1 balance $20,250). Using the same formula please input the cash needed for Year 3 on the spreadsheet. Repeat the process to calculate and enter the amounts for Years 2 & 3 for Accounts Receivable and Inventory. We also bought new equipment in each of the years. Again, Year 1 is simple - since we had no equipment before Year 1, the cash needed for equipment in Year 1 is simply the balances for Equipment (less depreciation) in Year 1. For Years 2 & 3, enter the net additional equipment (less depreciation) we bought each year. Using the same process above for Year 2, this is calculated as total Equipment for Year 2-depreciation for Year 2 ($100,000 - $50,000 = $50,000), then we must subtract total Equipment for Year 1 - depreciation for Year 1 ($30,000 - $10,000 = $20,000). So, the net cash needed for equipment in Year 2 is $50,000 - $20,000 = $30,000). As you can see this is already entered for you on the spreadsheet Please fill out the cells in the table for Years 2 & 3 on the Cash Worksheet for Week 5, using the same process. - What else do we need money for? Well, we lost money in Years 1 & 2 (Net Income was negative), so we need money to cover that. Just input the values on the Week 3 Income Statement spreadsheet for the total net income. However, we need to enter this on the Week 5 spreadsheet as the opposite of the numbers in Week 3, because in Year 1 we don't need -S100,000, we need a positive $100,000 to cover our loss. So, you can see in the spreadsheet I have entered $100,000 as the money needed. Please fill-in Years 2 & 3, using the same process. (Remember, this means that since we had a profit in Year 3, we enter it as a negative #, because we can use this profit to reduce the amount of cash we need.) The Cash Worksheet will calculate the total amount of money you need. Now we need to raise the cash to cover all of our needs, otherwise we will go bankrupt The business also receives money as the business grows, because the balances for Accounts Payable and Payroll Payable also grow. (Remember, Accounts Payable is the money our suppliers loan us for the materials we use to build our products. Why would they loan us money? Because, it is customary for businesses to give their business customers time to pay their involce - usually 30 days. If they don't do this, their customers will purchase the materials they need from a different supplier who does.) So even though it is a liability, something we owe it is a source of cash to us because we get 30 days to pay it, so it is like receiving a short-term loan. Again, the process is the same, for Year 1 we input the entire amount listed as Accounts Payable in our Balance Sheet from Week 4 into the Cash Sources for Year 1. And again, for Years 2 & 3 we enter the difference from the current year and the previous year. We do the same thing for Payroll Payable. (Remember, Payroll Payable is the money our employees Toan" us for the compensation we owe them (that they have already earned) between payroll checks. This business pays it's employees every 2 weeks, so on average we have 1 week (14 days - 6 days = 14 12 = 7 days) pay outstanding. Again, this is cash we can use in the short-term. Finally, we borrowed money from the bank. Enter the net amount hi new money we received from the bank for each of the 3 years. Remember, the amount shown on the Balance Sheet is the total running (or cumulative) balance of the bank loan. For the Cash Worksheet we only care about the increase for decrease) from year to year. Subtracting our Sources of Cash from our Cash Needed, we find we still need more cash for each year. This remaining amount will come from our investors. Though the amount needed from each year will be contributed by the investors - accounting rules dictate that we divide the amount into 2 categories: the investor's contribution for Year 1 is called Initial Capital stock, and the investor's contribution for Year 2, and all following years, is called Paid-in Capital. Just like retained earnings, the amount shown on the Balance Sheet is accumulated (which is a running total of all the Pald in Capital the investors have contributed). So, enter the total amount that we still need in Year 1, (this number stays the same for all 3 years). Then we enter the total amount that we still need In Year 2 in the Accumulated Paid in Capital cell for Year 2. In Year 3 we have to add he money we still need for Year 3 + the Accumulated Paid in Capital for Year 2. Now we are ready to transfer the numbers calculated in our Cash worksheet into the Balance Sheet itself. Input the total Initial Capital Stock from Year 1, from our Cash worksheet into Year 1 on the Balance Sheet. Since all subsequent contributions years are Paid-in Capital, the amount in Years 2 & 3 is the same as Year 1. Input the total Paid-In Capital from Years 1, 2 & 3 on our Cash worksheet into Years 1, 2 & 3 onto the Balance Sheet, (remember the amounts accumulate for Year 3). Lastly, enter the Accumulated Net income from Years 1, 2 & 3. You are donel You can check your work, by subtracting the Total Liabilities from the Total Assets, which if you are correct will equal the ge 2 of 2 1455 words QE Focus Llah Ala - Ahah tran mani alla - Ah the latest + 102%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts