Question: I don't think the first answer is correct, please type the other three thank u Wildhorse Company manufactures one product. On December 31, 2019, Wildhorse

I don't think the first answer is correct, please type the other three thank u

I don't think the first answer is correct, please type the other three thank u

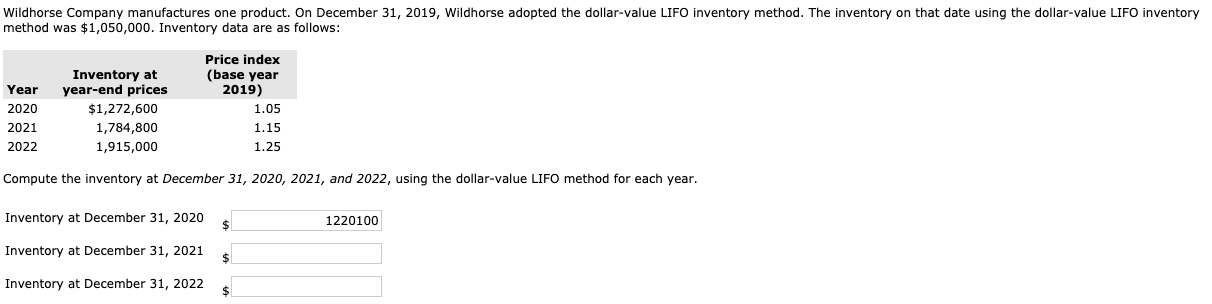

Wildhorse Company manufactures one product. On December 31, 2019, Wildhorse adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO inventory method was $1,050,000. Inventory data are as follows: Year 2020 2021 2022 Inventory at year-end prices $1,272,600 1,784,800 1,915,000 Price index (base year 2019) 1.05 1.15 1.25 Compute the inventory at December 31, 2020, 2021, and 2022, using the dollar-value LIFO method for each year. Inventory at December 31, 2020 1220100 Inventory at December 31, 2021 Inventory at December 31, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts