Question: i dont understand (4) Part 2: Adjusting Entry Questions (15 Marks) Note that the insurance company has a January 31 fiscal year-end. First, in the

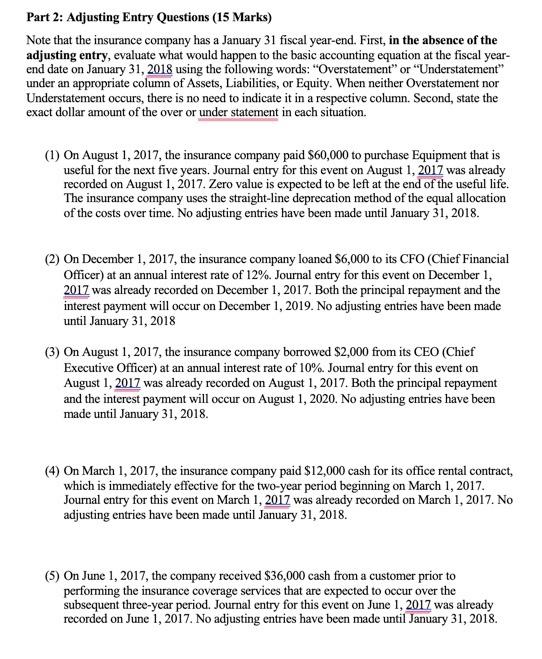

Part 2: Adjusting Entry Questions (15 Marks) Note that the insurance company has a January 31 fiscal year-end. First, in the absence of the adjusting entry, evaluate what would happen to the basic accounting equation at the fiscal year- end date on January 31, 2018 using the following words: "Overstatement" or "Understatement" under an appropriate column of Assets, Liabilities, or Equity. When neither Overstatement nor Understatement occurs, there is no need to indicate it in a respective column. Second, state the exact dollar amount of the over or under statement in each situation. (1) On August 1, 2017, the insurance company paid $60,000 to purchase Equipment that is useful for the next five years. Journal entry for this event on August 1, 2017 was already recorded on August 1, 2017. Zero value is expected to be left at the end of the useful life. The insurance company uses the straight-line deprecation method of the equal allocation of the costs over time. No adjusting entries have been made until January 31, 2018. (2) On December 1, 2017, the insurance company loaned $6,000 to its CFO (Chief Financial Officer) at an annual interest rate of 12%. Journal entry for this event on December 1, 2017 was already recorded on December 1, 2017. Both the principal repayment and the interest payment will occur on December 1, 2019. No adjusting entries have been made until January 31, 2018 (3) On August 1, 2017, the insurance company borrowed $2,000 from its CEO (Chief Executive Officer) at an annual interest rate of 10%. Journal entry for this event on August 1, 2017 was already recorded on August 1, 2017. Both the principal repayment and the interest payment will occur on August 1, 2020. No adjusting entries have been made until January 31, 2018. (4) On March 1, 2017, the insurance company paid $12,000 cash for its office rental contract, which is immediately effective for the two-year period beginning on March 1, 2017. Journal entry for this event on March 1, 2017 was already recorded on March 1, 2017. No adjusting entries have been made until January 31, 2018 (5) On June 1, 2017, the company received $36,000 cash from a customer prior to performing the insurance coverage services that are expected to occur over the subsequent three-year period. Journal entry for this event on June 1, 2017 was already recorded on June 1, 2017. No adjusting entries have been made until January 31, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts