Question: I don't understand A,C,D or E. Help Me understand this and show the work for me I'm very slow. A ) Pick out 6 and

I don't understand A,C,D or E. Help Me understand this and show the work for me I'm very slow.

A ) Pick out 6 and the amount.

A ) Pick out 6 and the amount.

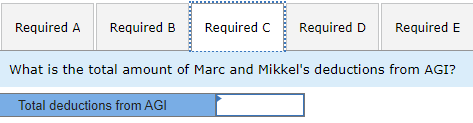

C ) Marc and Mikkel total deductions from AGI ?

C ) Marc and Mikkel total deductions from AGI ?

D ) Marc and Mikkel's taxable income?

D ) Marc and Mikkel's taxable income?

![information [The following information applies to the questions displayed below.] Marc and](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6718070162325_90467180700e057f.jpg) E ) Marc and Mikkel's taxes refund due for the year? Its not Taxes Playable.

E ) Marc and Mikkel's taxes refund due for the year? Its not Taxes Playable.

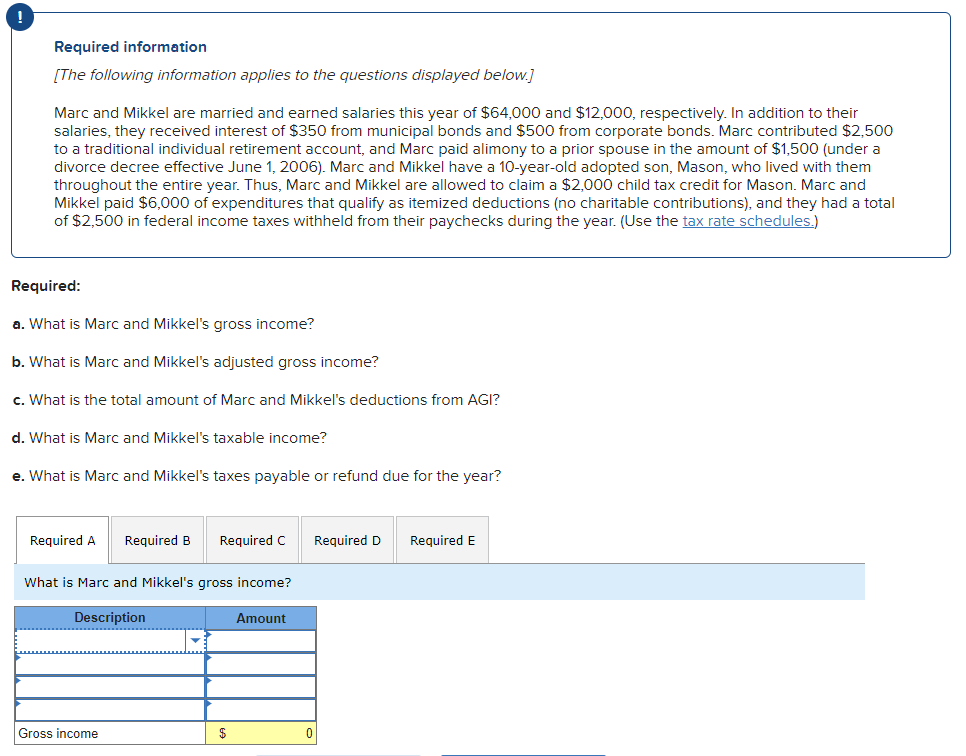

Required information [The following information applies to the questions displayed below.] Marc and Mikkel are married and earned salaries this year of $64,000 and $12,000, respectively. In addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2,500 to a traditional individual retirement account, and Marc paid alimony to a prior spouse in the amount of $1,500 (under a divorce decree effective June 1, 2006). Marc and Mikkel have a 10-year-old adopted son, Mason, who lived with them throughout the entire year. Thus, Marc and Mikkel are allowed to claim a $2,000 child tax credit for Mason. Marc and Mikkel paid $6,000 of expenditures that qualify as itemized deductions (no charitable contributions), and they had a total of $2,500 in federal income taxes withheld from their paychecks during the year. (Use the tax rate schedules.) Required: a. What is Marc and Mikkel's gross income? b. What is Marc and Mikkel's adjusted gross income? c. What is the total amount of Marc and Mikkel's deductions from AGI? d. What is Marc and Mikkel's taxable income? e. What is Marc and Mikkel's taxes payable or refund due for the year? What is Marc and Mikkel's gross income? Alimony paid Corporate bond interest IRA contribution Marc's salary Mikkel's salary Municipal bond interest What is the total amount of Marc and Mikkel's deductions from AGI? What is Marc and Mikkel's taxable income? What is Marc and Mikkel's taxes payable or refund due for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts