Question: i dont understand how to do it in excel Assume that on January 1, Comcast issues $500,000 of 5-year, 10% coupon bonds yielding an effective

i dont understand how to do it in excel

i dont understand how to do it in excel

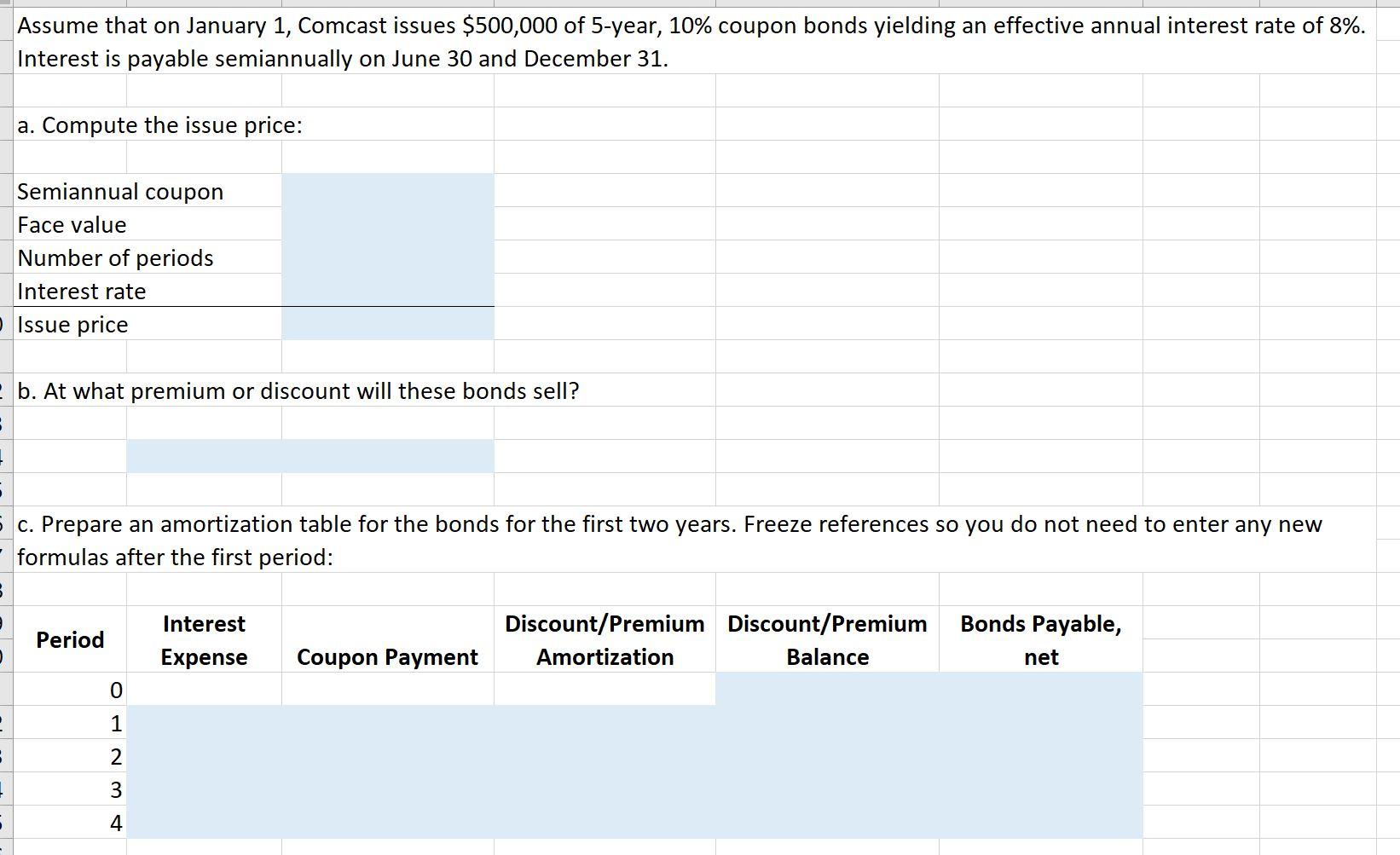

Assume that on January 1, Comcast issues $500,000 of 5-year, 10% coupon bonds yielding an effective annual interest rate of 8%. Interest is payable semiannually on June 30 and December 31. a. Compute the issue price: Semiannual coupon Face value Number of periods Interest rate Issue price b. At what premium or discount will these bonds sell? c. Prepare an amortization table for the bonds for the first two years. Freeze references so you do not need to enter any new formulas after the first period: Interest Period Discount/Premium Discount/Premium Amortization Balance Bonds Payable, net Expense Coupon Payment 0 1 2 . 3 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts