Question: I don't understand how to save the problems which come from chapter BONG and STOCK VALUATION 1.Astro's debenture has 10.50% current yield. The bond has

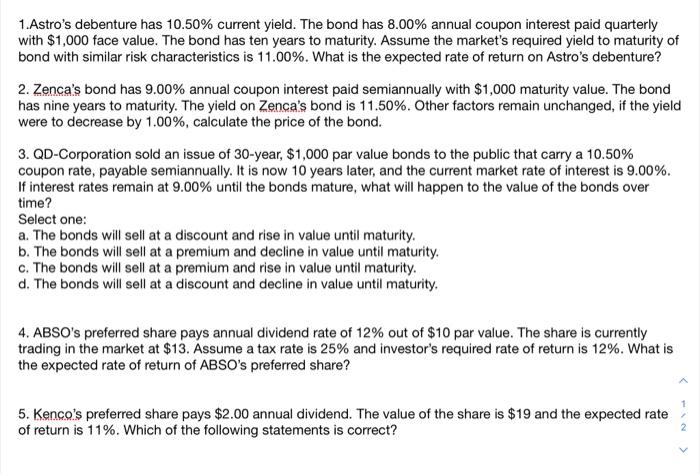

1.Astro's debenture has 10.50% current yield. The bond has 8.00% annual coupon interest paid quarterly with $1,000 face value. The bond has ten years to maturity. Assume the market's required yield to maturity of bond with similar risk characteristics is 11.00%. What is the expected rate of return on Astro's debenture? 2. Zenca's bond has 9.00% annual coupon interest paid semiannually with $1,000 maturity value. The bond has nine years to maturity. The yield on Zenca's bond is 11.50%. Other factors remain unchanged, if the yield were to decrease by 1.00%, calculate the price of the bond. 3. QD-Corporation sold an issue of 30-year, $1,000 par value bonds to the public that carry a 10.50% coupon rate, payable semiannually. It is now 10 years later, and the current market rate of interest is 9.00%. If interest rates remain at 9.00% until the bonds mature, what will happen to the value of the bonds over time? Select one: a. The bonds will sell at a discount and rise in value until maturity. b. The bonds will sell at a premium and decline in value until maturity. c. The bonds will sell at a premium and rise in value until maturity. d. The bonds will sell at a discount and decline in value until maturity. 4. ABSO's preferred share pays annual dividend rate of 12% out of $10 par value. The share is currently trading in the market at $13. Assume a tax rate is 25% and investor's required rate of return is 12%. What is the expected rate of return of ABSO's preferred share? 5. Kenco's preferred share pays $2.00 annual dividend. The value of the share is $19 and the expected rate of return is 11%. Which of the following statements is correct? N

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts