Question: i don't understand how to solve problem S9-7. can someone explain? thank you 59-0 APPms uncollectibles During its first year of operations, Fall Wine Tour

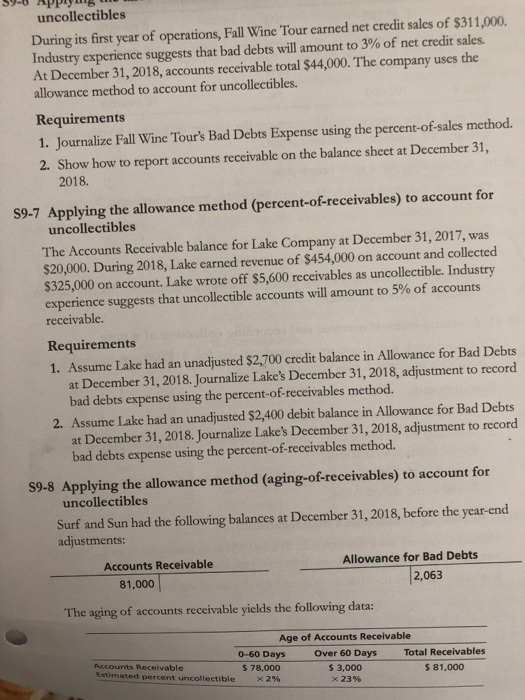

59-0 APPms uncollectibles During its first year of operations, Fall Wine Tour earned net credit sales of $311,000. Industry experience suggests that bad debts will amount to 3% of net credit sales. At December 31, 2018, accounts receivable total $44,000. The company uses the allowance method to account for uncollectibles. Requirements 1. Journalize Fall Wine Tour's Bad Debts Expense using the percent-of-sales method. 2. Show how to report accounts receivable on the balance sheet at December 31, 2018. 59-7 Applying the allowance method (percent-of-receivables) to account for uncollectibles The Accounts Receivable balance for Lake Company at December 31, 2017, was $20,000. During 2018, Lake earned revenue of $454,000 on account and collected $325,000 on account. Lake wrote off $5,600 receivables as uncollectible. Industry experience suggests that uncollectible accounts will amount to 5% of accounts receivable. Requirements 1. Assume Lake had an unadjusted $2,700 credit balance in Allowance for Bad Debts at December 31, 2018. Journalize Lake's December 31, 2018, adjustment to record bad debts expense using the percent-of-receivables method. 2. Assume Lake had an unadjusted $2,400 debit balance in Allowance for Bad Debts at December 31, 2018. Journalize Lake's December 31, 2018, adjustment to record bad debts expense using the percent-of-receivables method. 59-8 Applying the allowance method (aging-of-receivables) to account for uncollectibles Surf and Sun had the following balances at December 31, 2018, before the year-end adjustments: Accounts Receivable 81,000 Allowance for Bad Debts 2,063 The aging of accounts receivable yields the following data: Age of Accounts Receivable 0-60 Days Over 60 Days Total Receivables Accounts Receivable $ 78,000 $3,000 $81,000 imated percent uncollectible x 29 x 23%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts