Question: I don't understand how to solve this question Suppose the interest rate for borrowing and lending is a constant 1% per month. How could you

I don't understand how to solve this question

I don't understand how to solve this question

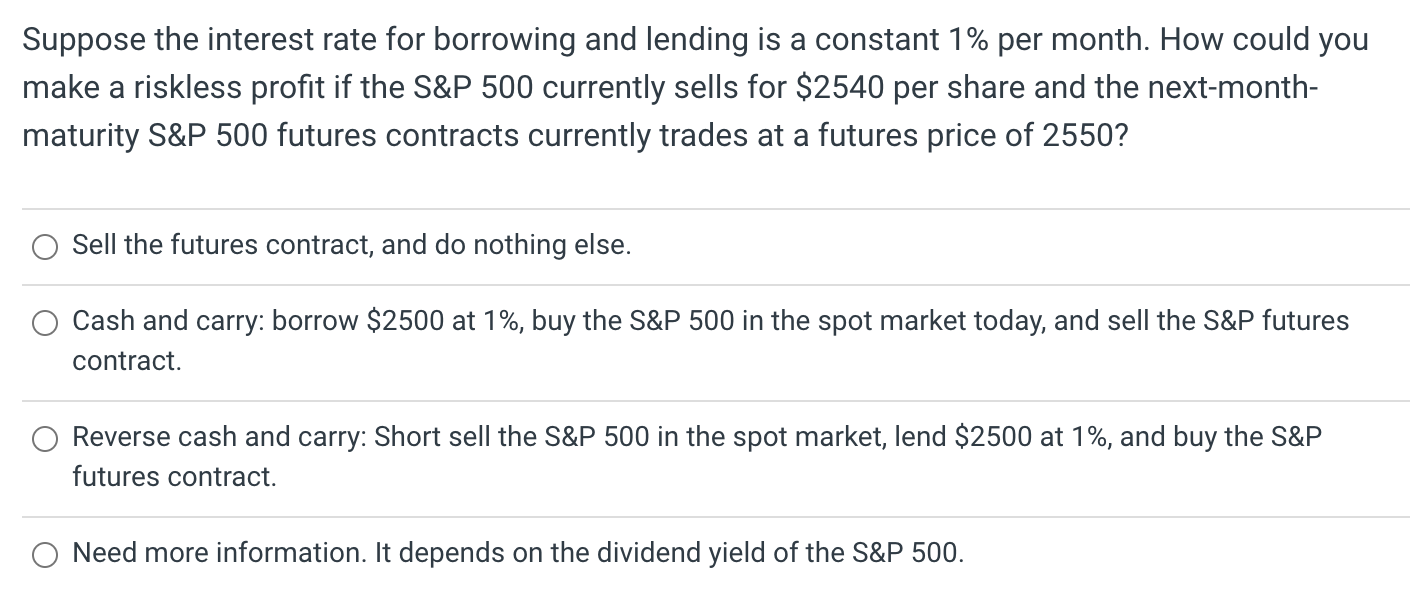

Suppose the interest rate for borrowing and lending is a constant 1% per month. How could you make a riskless profit if the S&P 500 currently sells for $2540 per share and the next-month- maturity S&P 500 futures contracts currently trades at a futures price of 2550? O Sell the futures contract, and do nothing else. Cash and carry: borrow $2500 at 1%, buy the S&P 500 in the spot market today, and sell the S&P futures contract. O Reverse cash and carry: Short sell the S&P 500 in the spot market, lend $2500 at 1%, and buy the S&P futures contract. O Need more information. It depends on the dividend yield of the S&P 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts