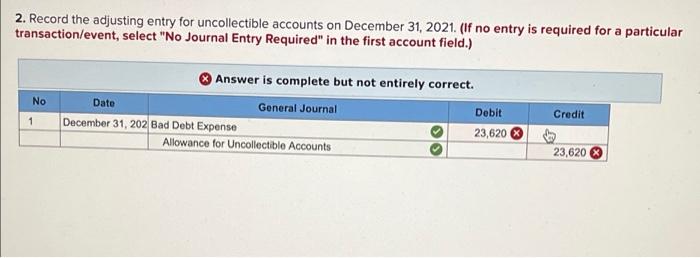

Question: i dont understand the asjusting entry . how do I know its bad debt expense on debit side . can you explain which adjusting entry

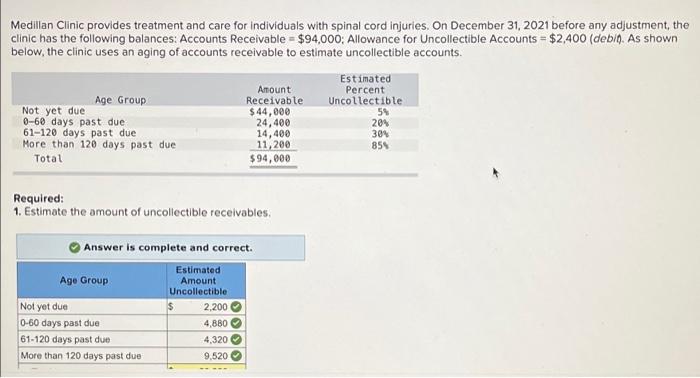

Medillan Clinic provides treatment and care for individuals with spinal cord injuries. On December 31, 2021 before any adjustment, the clinic has the following balances: Accounts Receivable = $94,000: Allowance for Uncollectible Accounts = $2,400 (deb/m. As shown below, the clinic uses an aging of accounts receivable to estimate uncollectible accounts. Age Group Not yet due 0-60 days past due 61-120 days past due More than 120 days past due Total Amount Receivable $ 44,000 24,400 14,400 11,200 $94,000 Estimated Percent Uncollectible 54 204 304 855 Required: 1. Estimate the amount of uncollectible receivables, Answer is complete and correct. Estimated Age Group Amount Uncollectible Not yet due $ 2,200 0-60 days past due 4,880 61-120 days past due 4,320 More than 120 days past due 9.520 2. Record the adjusting entry for uncollectible accounts on December 31, 2021. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) a No Answer is complete but not entirely correct. Date General Journal Debit December 31, 202 Bad Debt Expense 23,620 Allowance for Uncollectible Accounts Credit 1 23,620

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts