Question: I don't understand the solution provided. Would it be possible to have a more detailed explanation please? 2) (10 points, 15 mins) Today is t

I don't understand the solution provided. Would it be possible to have a more detailed explanation please?

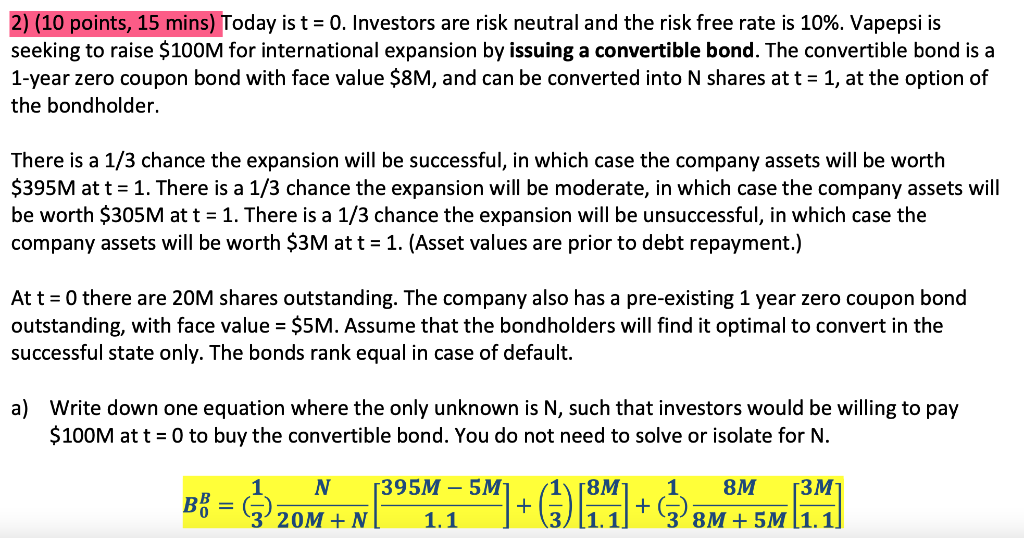

2) (10 points, 15 mins) Today is t = 0. Investors are risk neutral and the risk free rate is 10%. Vapepsi is seeking to raise $100M for international expansion by issuing a convertible bond. The convertible bond is a 1-year zero coupon bond with face value $8M, and can be converted into N shares at t = 1, at the option of the bondholder. There is a 1/3 chance the expansion will be successful, in which case the company assets will be worth $395M at t = 1. There is a 1/3 chance the expansion will be moderate, in which case the company assets will be worth $305M at t = 1. There is a 1/3 chance the expansion will be unsuccessful, in which case the company assets will be worth $3M at t = 1. (Asset values are prior to debt repayment.) At t = 0 there are 20M shares outstanding. The company also has a pre-existing 1 year zero coupon bond outstanding, with face value = $5M. Assume that the bondholders will find it optimal to convert in the successful state only. The bonds rank equal in case of default. a) Write down one equation where the only unknown is N, such that investors would be willing to pay $100M at t = 0 to buy the convertible bond. You do not need to solve or isolate for N. 1 N Be = ) 20M+NI 395M 5M 1.1 5M]+CH. 1 8M 3 ] + 8M + 5M (1.1 2) (10 points, 15 mins) Today is t = 0. Investors are risk neutral and the risk free rate is 10%. Vapepsi is seeking to raise $100M for international expansion by issuing a convertible bond. The convertible bond is a 1-year zero coupon bond with face value $8M, and can be converted into N shares at t = 1, at the option of the bondholder. There is a 1/3 chance the expansion will be successful, in which case the company assets will be worth $395M at t = 1. There is a 1/3 chance the expansion will be moderate, in which case the company assets will be worth $305M at t = 1. There is a 1/3 chance the expansion will be unsuccessful, in which case the company assets will be worth $3M at t = 1. (Asset values are prior to debt repayment.) At t = 0 there are 20M shares outstanding. The company also has a pre-existing 1 year zero coupon bond outstanding, with face value = $5M. Assume that the bondholders will find it optimal to convert in the successful state only. The bonds rank equal in case of default. a) Write down one equation where the only unknown is N, such that investors would be willing to pay $100M at t = 0 to buy the convertible bond. You do not need to solve or isolate for N. 1 N Be = ) 20M+NI 395M 5M 1.1 5M]+CH. 1 8M 3 ] + 8M + 5M (

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts