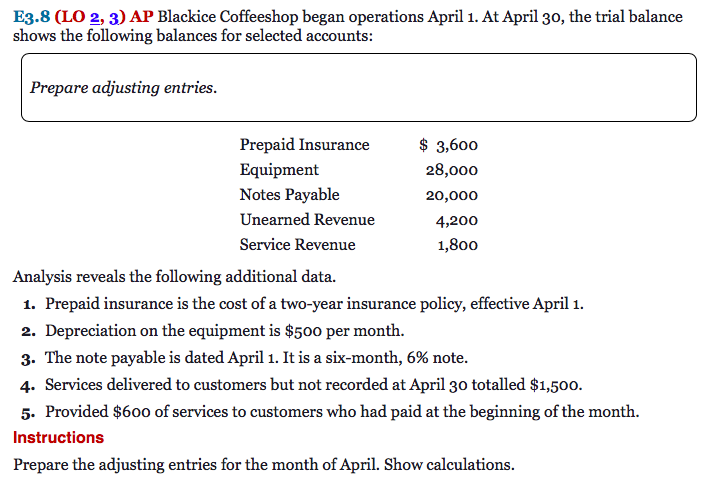

Question: I don't understand these things. thanks for helping me E3.8 (LO 2, 3) AP Blackice Coffeeshop began operations April 1. At April 30, the trial

I don't understand these things. thanks for helping me

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock