Question: i dont understand this and read it ans write a clear please 2) Zainah Incorporated purchased all of the outstanding stock of Mustafa Company paying

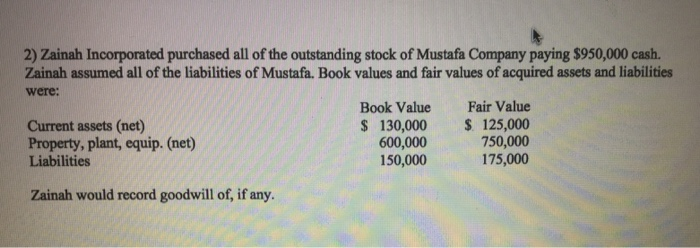

2) Zainah Incorporated purchased all of the outstanding stock of Mustafa Company paying $950,000 cash. Zainah assumed all of the liabilities of Mustafa. Book values and fair values of acquired assets and liabilities were: Book Value Fair Value Current assets (net) $ 130,000 $ 125,000 Property, plant, equip. (net) 600,000 750,000 Liabilities 150,000 175,000 Zainah would record goodwill of, if any

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts