Question: I don't understand this could I please get some help? Katie, your Accounting Manager, has asked you to calculate the depreciation for the new company

I don't understand this could I please get some help?

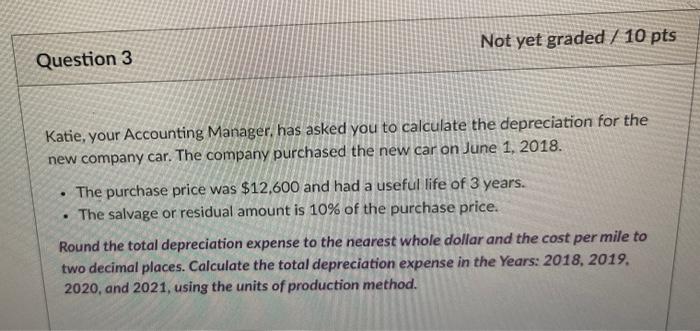

Katie, your Accounting Manager, has asked you to calculate the depreciation for the new company car. The company purchased the new car on June 1, 2018.

- The purchase price was $12,600 and had a useful life of 3 years.

- The salvage or residual amount is 10% of the purchase price.

Round the total depreciation expense to the nearest whole dollar and the cost per mile to two decimal places. Calculate the total depreciation expense in the Years: 2018, 2019, 2020, and 2021, using the units of production method.

Not yet graded / 10 pts Question 3 Katie, your Accounting Manager, has asked you to calculate the depreciation for the new company car. The company purchased the new car on June 1, 2018. The purchase price was $12,600 and had a useful life of 3 years. The salvage or residual amount is 10% of the purchase price. . Round the total depreciation expense to the nearest whole dollar and the cost per mile to two decimal places. Calculate the total depreciation expense in the Years: 2018, 2019. 2020, and 2021, using the units of production method. Not yet graded / 10 pts Question 3 Katie, your Accounting Manager, has asked you to calculate the depreciation for the new company car. The company purchased the new car on June 1, 2018. The purchase price was $12,600 and had a useful life of 3 years. The salvage or residual amount is 10% of the purchase price. . Round the total depreciation expense to the nearest whole dollar and the cost per mile to two decimal places. Calculate the total depreciation expense in the Years: 2018, 2019. 2020, and 2021, using the units of production method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts