Question: I don't understand this. Please thoroughly explain. I m trying to complete it with paper and pencil. Please fully explain how I show calculate not

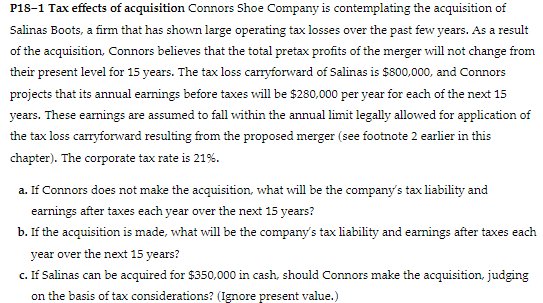

I don't understand this. Please thoroughly explain. Im trying to complete it with paper and pencil. Please fully explain how I show calculate not understanding how.P Tax effects of acquisition Connors Shoe Company is contemplating the acquisition of

Salinas Boots, a firm that has shown large operating tax losses over the past few years. As a result

of the acquisition, Connors believes that the total pretax profits of the merger will not change from

their present level for years. The tax loss carryforward of Salinas is $ and Connors

projects that its annual earnings before taxes will be $ per year for each of the next

years. These earnings are assumed to fall within the annual limit legally allowed for application of

the tax loss carryforward resulting from the proposed merger see footnote earlier in this

chapter The corporate tax rate is

a If Connors does not make the acquisition, what will be the company's tax liability and

earnings after taxes each year over the next years?

b If the acquisition is made, what will be the company's tax liability and earnings after taxes each

year over the next years?

c If Salinas can be acquired for $ in cash, should Connors make the acquisition, judging

on the basis of tax considerations? Ignore present value.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock