Question: i don't understand this question, could you help me finish it. F200 Assignment Two (35 points possible) ALSO: PLEASE PUT mm 0N ram W'ORKI Use

i don't understand this question, could you help me finish it.

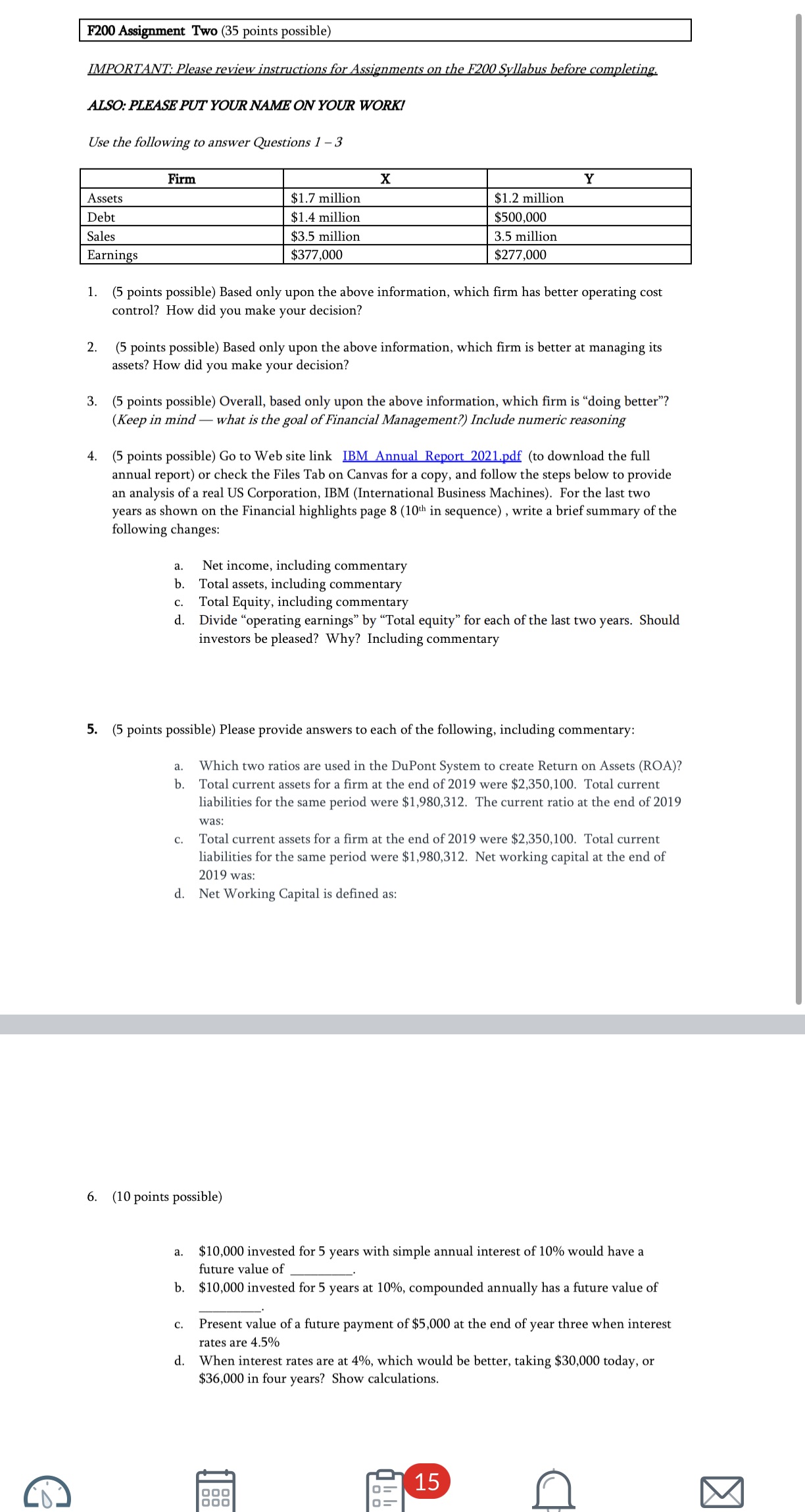

F200 Assignment Two (35 points possible) ALSO: PLEASE PUT mm 0N ram W'ORKI Use die $110ng to answer Questions I - 3 $1 7 million $1 2 million $500,000 Sales $3.5 million 3.5 million Earnin_ 5 $377,000 $277,000 1. (5 points possible) Based only upon the above information, which rm has better operating cost control? How did you make your decision? 2. (5 points possible) Based only upon the above information, which rm is better at managing its assets? How did you make your decision? 3. (5 points possible) Overall, based only upon the above information, which rm is \"doing better\"? (Keep in mind What is the goal ofnanaal Management?) Include numeric reasoning 4i (5 points possible) Go to Web site link W (to download the full annual report) or check the Files Tab on Canvas for a copy, and follow the steps below to provide an analysis of a real US Corporation, IBM (International Business Machines). For the last two years as shown on the Financial highlights page 8 (10\" in sequence) , write a briefsummary of the following changes: a b. c. d Net income, including commentary Total assets, including commentary Total Equity, including commentary Divide \"operating earnings" by \"Total equity" for each of the last two years; Should investors be pleased? Why? Including commentary 5. (5 points possible) Please provide answers to each of the following, including commentary: P\" Which two ratios are used in the DuPont System to create Return on Assets (RCA)? Total current assets for a firm at the end of 2019 were $2,350,100 Total current liabilities for the same period were $1,980,312 The current ratio at the end of2019 was: Total current assets for a firm at the end of2019 were $2,350,100. Total current liabilities for the same period were $1,980.312. Net working capital at the end of 2019 was: Net Working Capital is dened as: 6. (10 points possible) $10,000 invested for 5 years with simple annual interest of 10% would have a future value of 7 $10,000 invested for 5 years at 10%, compounded annually has a future value of Present value of a future payment of$5,000 at the end of year three when interest rates are 4.5% When interest rates are at 4%, which would be better. taking $30,000 today, or $36,000 in four years? Show calculations can 0- 000 E

F200 Assignment Two (35 points possible) ALSO: PLEASE PUT mm 0N ram W'ORKI Use die $110ng to answer Questions I - 3 $1 7 million $1 2 million $500,000 Sales $3.5 million 3.5 million Earnin_ 5 $377,000 $277,000 1. (5 points possible) Based only upon the above information, which rm has better operating cost control? How did you make your decision? 2. (5 points possible) Based only upon the above information, which rm is better at managing its assets? How did you make your decision? 3. (5 points possible) Overall, based only upon the above information, which rm is \"doing better\"? (Keep in mind What is the goal ofnanaal Management?) Include numeric reasoning 4i (5 points possible) Go to Web site link W (to download the full annual report) or check the Files Tab on Canvas for a copy, and follow the steps below to provide an analysis of a real US Corporation, IBM (International Business Machines). For the last two years as shown on the Financial highlights page 8 (10\" in sequence) , write a briefsummary of the following changes: a b. c. d Net income, including commentary Total assets, including commentary Total Equity, including commentary Divide \"operating earnings" by \"Total equity" for each of the last two years; Should investors be pleased? Why? Including commentary 5. (5 points possible) Please provide answers to each of the following, including commentary: P\" Which two ratios are used in the DuPont System to create Return on Assets (RCA)? Total current assets for a firm at the end of 2019 were $2,350,100 Total current liabilities for the same period were $1,980,312 The current ratio at the end of2019 was: Total current assets for a firm at the end of2019 were $2,350,100. Total current liabilities for the same period were $1,980.312. Net working capital at the end of 2019 was: Net Working Capital is dened as: 6. (10 points possible) $10,000 invested for 5 years with simple annual interest of 10% would have a future value of 7 $10,000 invested for 5 years at 10%, compounded annually has a future value of Present value of a future payment of$5,000 at the end of year three when interest rates are 4.5% When interest rates are at 4%, which would be better. taking $30,000 today, or $36,000 in four years? Show calculations can 0- 000 E Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock