Question: i dont understand this question. please use this formula for FCF and show steps so i can undertand. thank you! You must estimate the intrinsic

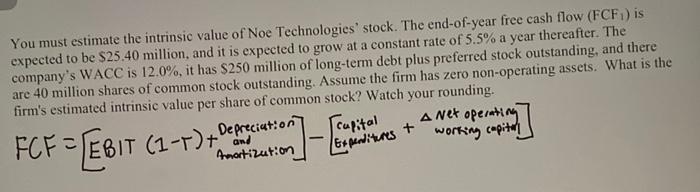

You must estimate the intrinsic value of Noe Technologies' stock. The end-of-year free cash flow (FCF) is expected to be $25.40 million, and it is expected to grow at a constant rate of 5.5% a year thereafter. The company's WACC is 12.0%, it has $250 million of long-term debt plus preferred stock outstanding, and there are 40 million shares of common stock outstanding. Assume the firm has zero non-operating assets. What is the firm's estimated intrinsic value per share of common stock? Watch your rounding. A Net operating working capital Amortization FCF = EBIT (1-1) 4Depreciation () Expenditures +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts