Question: I don't understand what I am missing here. Pretty sure it's the beginning balances from year one but I tried both credit and debit spots.

I don't understand what I am missing here. Pretty sure it's the beginning balances from year one but I tried both credit and debit spots. I attached the year one complete answer for help. I just need help with the year two T-Accounts. I have all the correct general journal entries. So I don't need them answered. Thanks for the help!

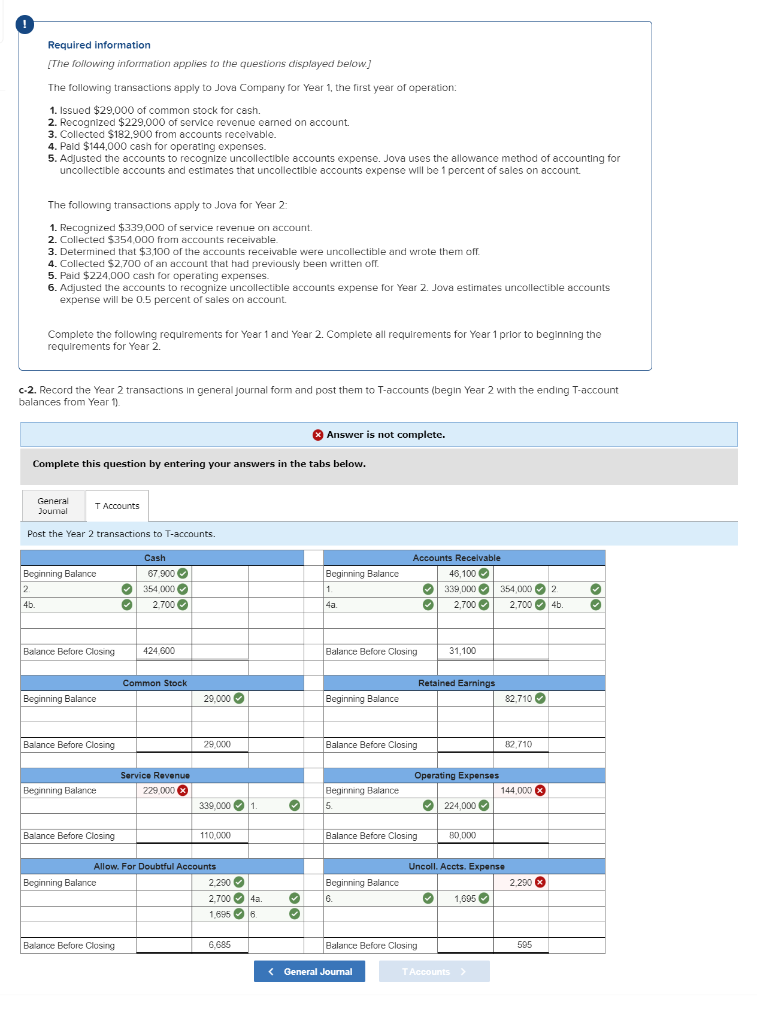

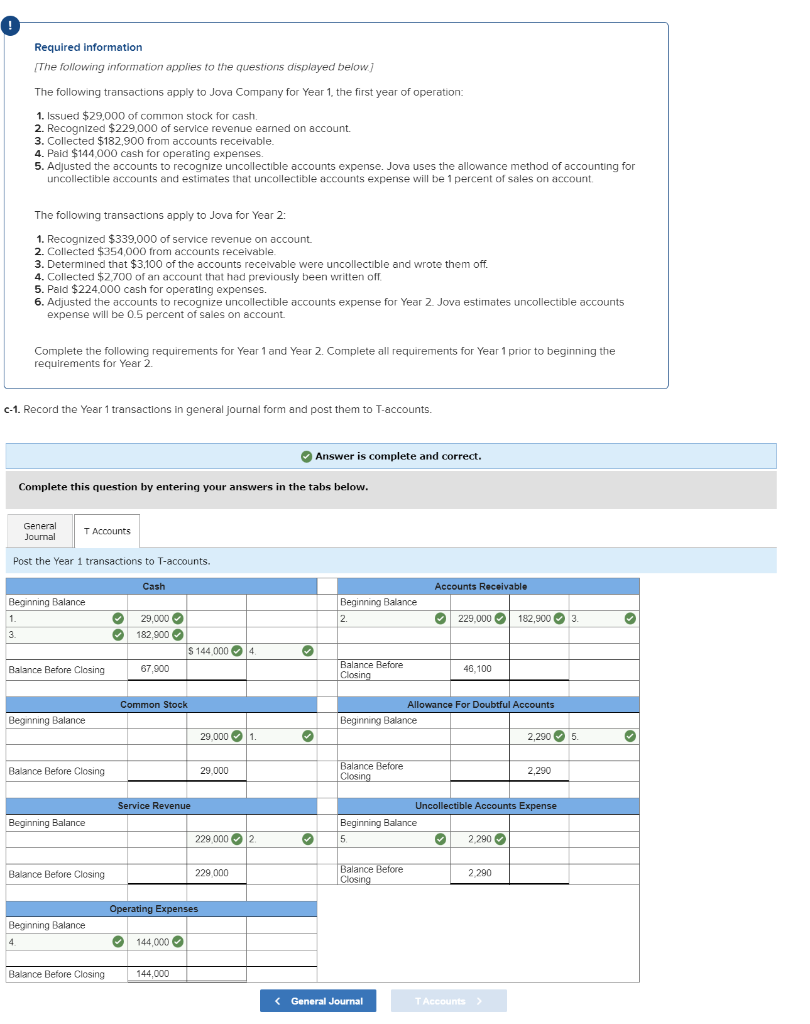

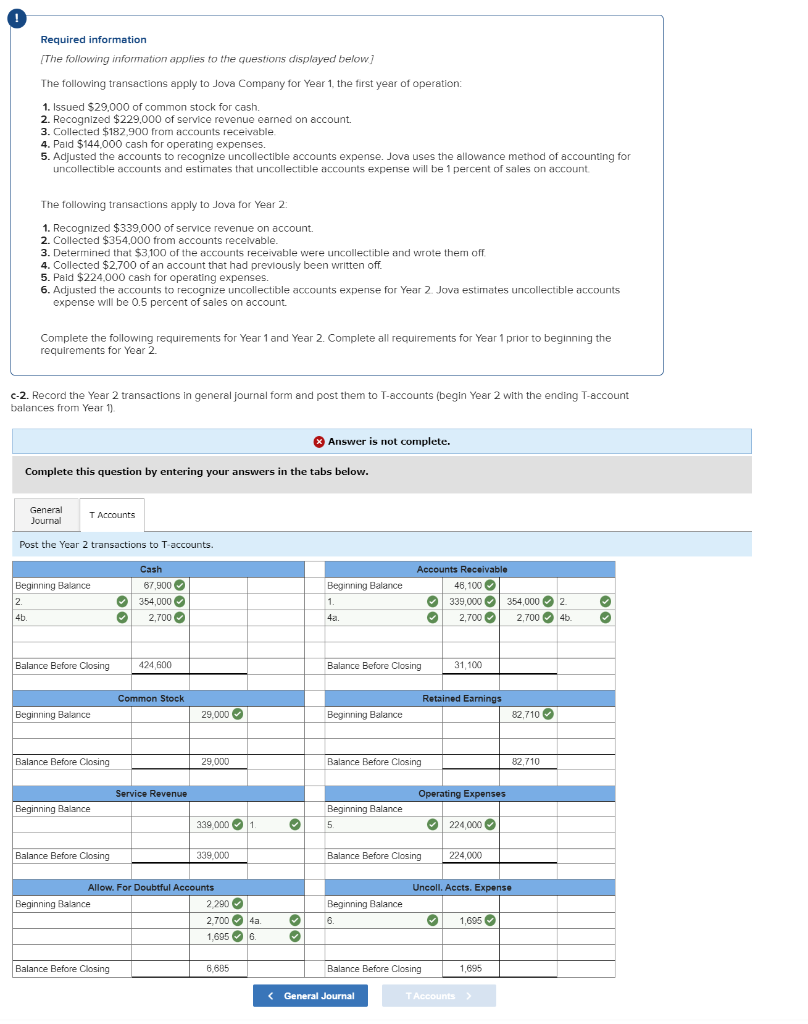

Required information [The following information applies to the questions displayed below.] The following transactions apply to Jova Company for Year 1, the first year of operation: 1 1. Issued $29,000 of common stock for cash. 2. Recognized $229,000 of service revenue eamed on account 3. Collected $182,900 from accounts receivable. 4. Paid $144,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 1 percent of sales on account The following transactions apply to Jova for Year 2 1. Recognized $339,000 of service revenue on account. 2. Collected $354,000 from accounts receivable. 3. Determined that $3,100 of the accounts receivable were uncollectible and wrote them off. 4. Collected $2,700 of an account that had previously been written of 5. Paid $224,000 cash for operating expenses 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2. c-2. Record the Year 2 transactions in general Journal form and post them to T-accounts (begin Year 2 with the ending T-account balances from Year 1). & Answer is not complete. Complete this question by entering your answers in the tabs below. General Joumal T Accounts Post the Year 2 transactions to T-accounts. 2 -. Cash Beginning Balance 2 4b. 67.900 354 000 2.700 Beginning Balance 1 Accounts Receivable 46,100 339,000 3540002 2.700 2,700 46. 4b 4a. Balance Before Closing 424 600 Balance Before Closing 31,100 Common Stock Retained Earnings Beginning Balance 29.000 Beginning Balance 82.710 Balance Before Closing 29,000 Balance Before Closing 82,710 Service Revenue 229 000 X Beginning Balance Beginning Balance 5 Operating Expenses 144.000 X 224,000 339,0001 . Balance Before Closing 110,000 Balance Before Closing 30 000 Uncoll. Accts. Expense 2.290 x Allow. For Doubtful Accounts Beginning Balance 2.290 2.7004a. 1,6956 Beginning Balance 6. 1,695 Balance Before Closing 6,685 Balance Before Closing 595 Required information [The following information applies to the questions displayed below) The following transactions apply to Jova Company for Year 1, the first year of operation: 1. Issued $29,000 of common stock for cash 2. Recognized $229,000 of service revenue earned on account. 3. Collected $182.900 from accounts receivable. 4. Paid $144,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 1 percent of sales on account. The following transactions apply to Jova for Year 2: 1. Recognized $339,000 of service revenue on account 2. Collected $354,000 from accounts receivable. 3. Determined that $3,100 of the accounts receivable were uncollectible and wrote them off. 4. Collected $2,700 of an account that had previously been written oll 5. Pald $224,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2. Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2 c-1. Record the Year 1 transactions in general journal form and post them to T-accounts. Answer is complete and correct. Complete this question by entering your answers in the tabs below. General Journal T Accounts Post the Year 1 transactions to T-accounts. - Cash Accounts Receivable Beginning Balance 1. 3. Beginning Balance 2. 229,000 182,9003. 29,000 182,900 $ 144 000 4 Balance Before Closing 67,900 Balance Before Closing 46,100 Common Stock Beginning Balance Allowance For Doubtful Accounts Beginning Balance 2,2905. 29.0001 . Balance Before Closing 29.000 Balance Before Closing 2,290 Service Revenue Beginning Balance Uncollectible Accounts Expense Beginning Balance 5 2,290 229 0002 Balance Before Closing 229 000 Balance Before Closing 2,290 Operating Expenses Beginning Balance 4 144,000 Balance Before Closing 144,000 (General Journal TAccounts Required information The following information applies to the questions displayed below] The following transactions apply to Jova Company for Year 1, the first year of operation: : 1. Issued $29,000 of common stock for cash. 2. Recognized $229,000 of service revenue earned on account. 3. Collected $182,900 from accounts receivable 4. Paid $144,000 cash for operating expenses. 5. Adjusted the accounts to recognize uncollectible accounts expense. Jova uses the allowance method of accounting for uncollectible accounts and estimates that uncollectible accounts expense will be 1 percent of sales on account The following transactions apply to Jova for Year 2: 1. Recognized $339,000 of service revenue on account. 2. Collected $354,000 from accounts receivable. 3. Determined that $3100 of the accounts receivable were uncollectible and wrote them off 4. Collected $2,700 of an account that had previously been written off 5. Paid $224,000 cash for operating expenses. 6. Adjusted the accounts to recognize uncollectible accounts expense for Year 2 Jova estimates uncollectible accounts expense will be 0.5 percent of sales on account. Complete the following requirements for Year 1 and Year 2. Complete all requirements for Year 1 prior to beginning the requirements for Year 2 c-2. Record the Year 2 transactions in general journal form and post them to T-accounts (begin Year 2 with the ending T-account balances from Year 1) * Answer is not complete. Complete this question by entering your answers in the tabs below. General Journal T Accounts Post the Year 2 transactions to T-accounts. 2 - Beginning Balance 12 Cash 67.900 354,000 2.700 Beginning Balance 1 Accounts Receivable 46,100 339,000 354,000 2 2,700 2.70046 4b. 4a. Balance Before Closing 424 600 Balance Before Closing 31,100 Common Stock Retained Earnings Beginning Balance 29.000 Beginning Balance 82,710 Balance Before Closing 29,000 Balance Before Closing 82,710 Service Revenue Operating Expenses Beginning Balance Beginning Balance 5 339,000 1 224 000 Balance Before Closing 339,000 Balance Before Closing 224,000 Uncoll. Accts. Expense Allow. For Doubtful Accounts Beginning Balance 2 290 2,7004a. 1,6956 . Beginning Balance 6. 1,695 Balance Before Closing 6,685 Balance Before Closing 1,695

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts