Question: * * * I don't understand what numbers go in the yellow blanks at the top under the condensed balance sheet * * * *

I don't understand what numbers go in the yellow blanks at the top under the condensed balance sheet

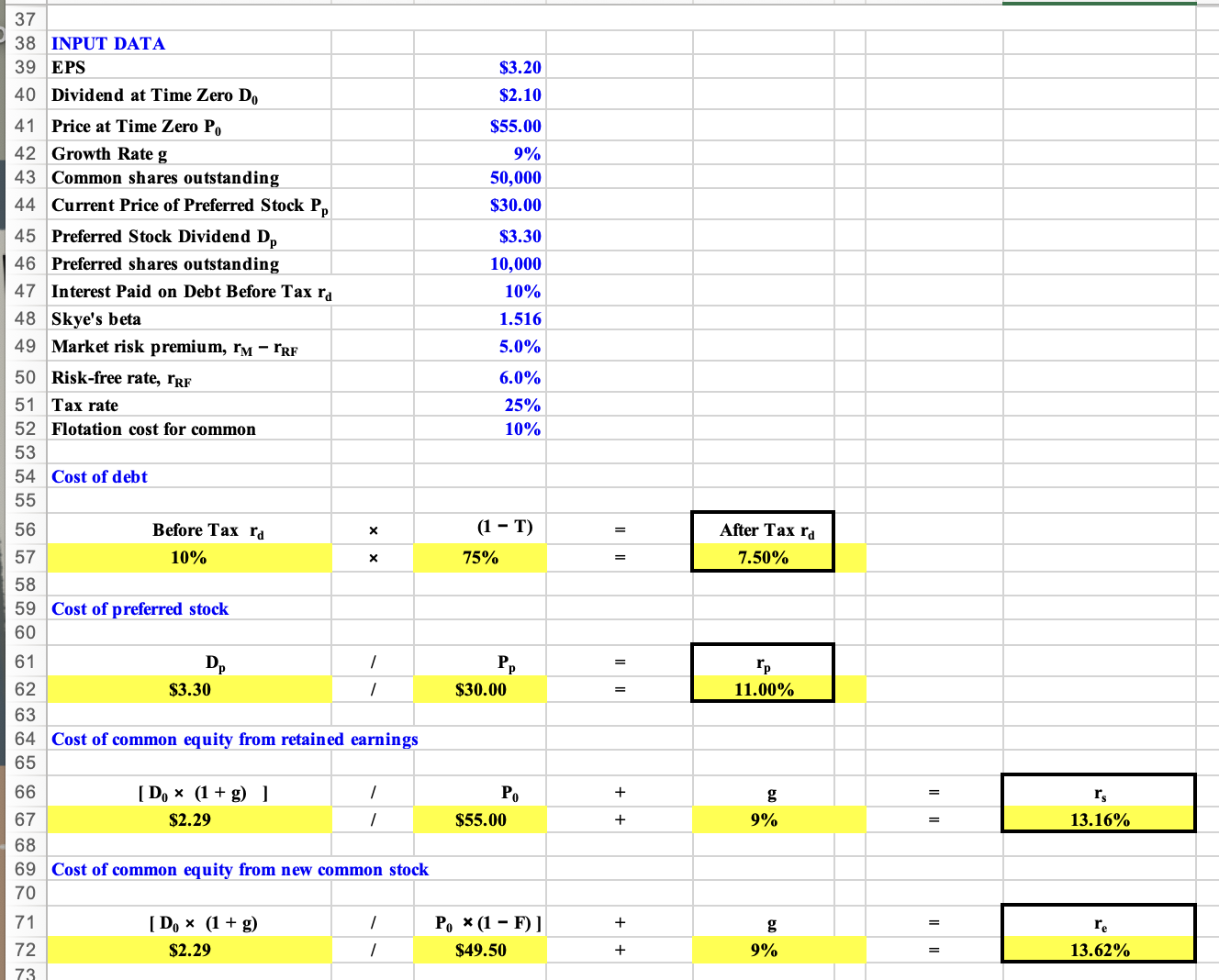

Skye's earnings per share last year were $ The common stock sells for $ last year's dividend was $ and a flotation cost of

would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of

Skye's preferred stock pays a dividend of $ per share, and its preferred stock sells for $ per share. The firm's beforetax cost of

debt is and its marginal tax rate is The firm's currently outstanding annual coupon rate, longterm debt sells at par value.

The market risk premium is the riskfree rate is and Skye's beta is The firm's total debt, which is the sum of the company's

shortterm debt and longterm debt, equals $ million.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock