Question: I don't understand why each date needs an adjustment or how to start the journal for them. Problem 12.2A Recording adjustments for accrued and prepaid

I don't understand why each date needs an adjustment or how to start the journal for them.

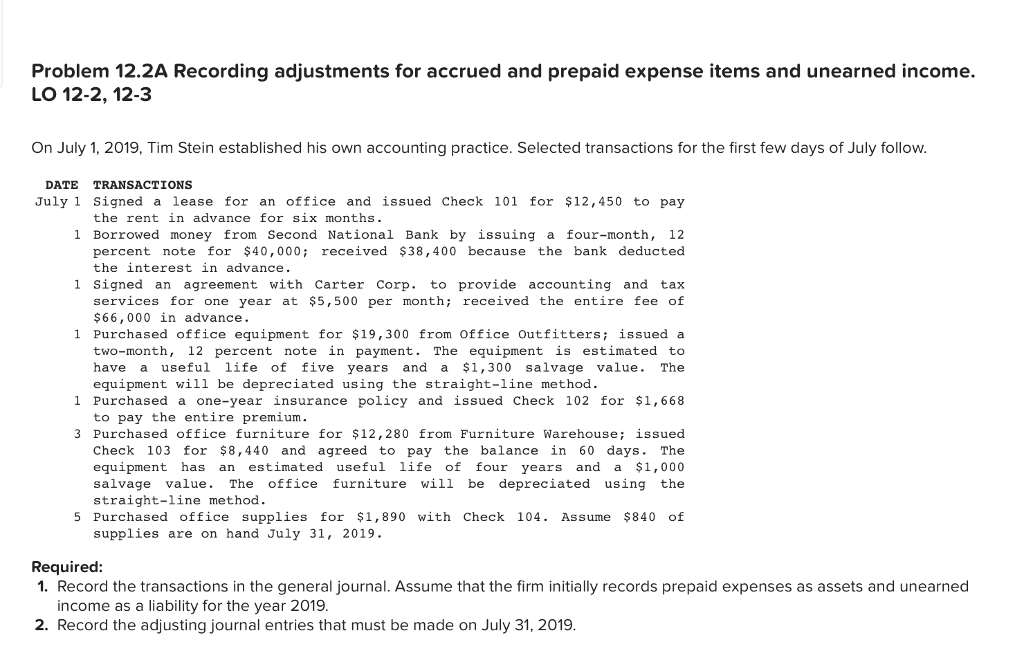

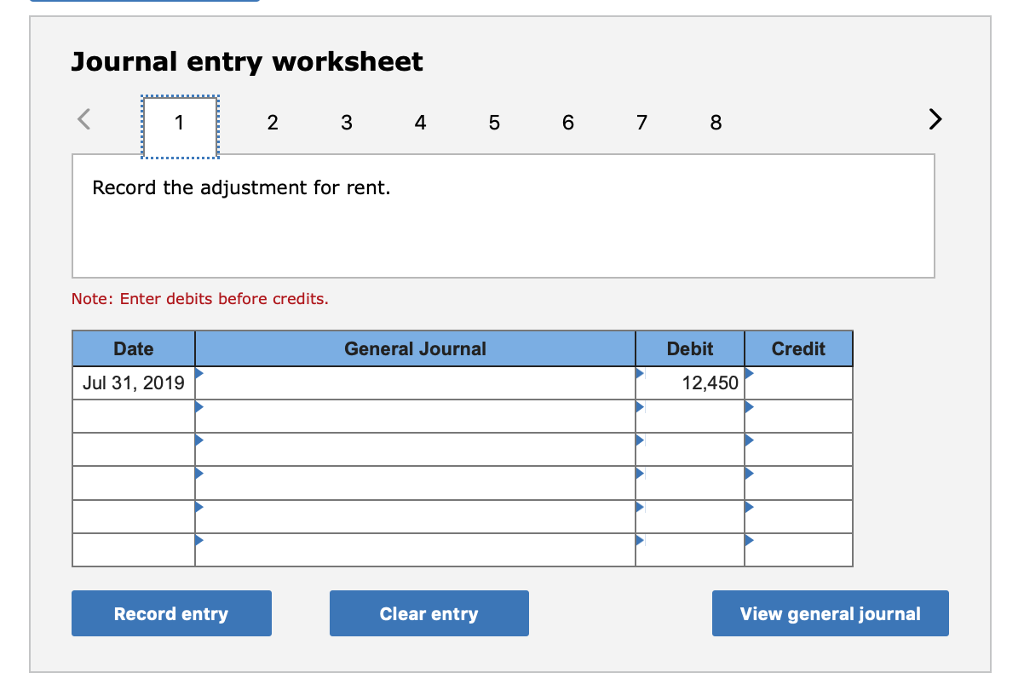

Problem 12.2A Recording adjustments for accrued and prepaid expense items and unearned income. LO 12-2, 12-3 On July 1, 2019, Tim Stein established his own accounting practice. Selected transactions for the first few days of July follow DATE TRANSACTIONS July 1 Signed a lease for an office and issued Check 101 for 12,450 to pay the rent in advance for six months. 1 Borrowed money from Second National Bank by issuing a four-month, 12 percent note for $40,000 received $38,400 because the bank deducted the interest in advance 1 Signed an agreement with Carter Corp. to provide accounting and tax services for one year at $5,500 per month; received the entire fee of $66, 000 in advance. 1 Purchased office equipment for $19,300 from Office Outfitters; issued a two-month, 12 percent note in payment. The equipment is estimated to have a useful life of five years and a $1,300 salvage value. The equipment wil be depreciated using the straight-line method 1 Purchased a one-year insurance policy and issued Check 102 for $1,668 to pay the entire premium. 3 Purchased office furniture for $12,280 from Furniture Warehouse; issued Check 103 for $8,440 and agreed to pay the balance in 60 days. The equipment has an estimated usefullife of four years and a $1,000 salvage value. The office furniture will be depreciated using the straight-line method 5 Purchased office supplies for $1,890 with Check 104. Assume $840 of supplies are on hand July 31, 2019 Required: 1. Record the transactions in the general journal. Assume that the firm initially records prepaid expenses as assets and unearned income as a liability for the year 2019 2. Record the adjusting journal entries that must be made on July 31, 2019 Journal entry worksheet 2 3 4 6 7 8 Record the adjustment for rent. Note: Enter debits before credits Date General Journal Debit Credit Jul 31, 2019 12,450 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts