Question: I dont understand why the recognized gain is 0 the answer is provided but can someone explain? 203. Lily exchanges a building she uses in

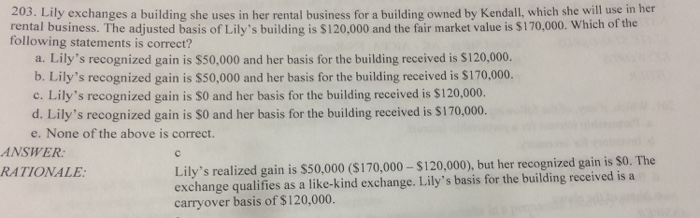

203. Lily exchanges a building she uses in her rental business for a building owned by Kendall, which she will use in her 203. Lily exchanges a building she uses in her rental business for a building owned by Kendall, which she wi rental business. The adjusted basis of Lily's building is S120,000 and the fair market value is $170,000. Which of the following statements is correct? statements is correct) s of Lily's building is $120.000 a. Lily's recognized gain is $50,000 and her basis for the building received is S120,000. b. Lily's recognized gain is $50,000 and her basis for the building received is $170.000. c. Lily's recognized gain is $0 and her basis for the building received is $120,000. d. Lily's recognized gain is $0 and her basis for the building received is $170,000. e. None of the above is correct. ANSWER RATIONALE Lily's realized gain is $50,000 (S170,000 - $120,000), but her recognized gain is SO. The exchange qualifies as a like-kind exchange. Lily's basis for the building received is a carryover basis of $120,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts