Question: I don't want just solution. Please explain the solution too as I am a newbie in Finance. EXAMPLE 2: FCFE VALUATION MODEL PQ has 1

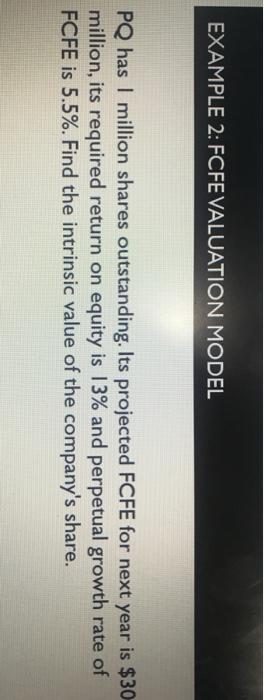

EXAMPLE 2: FCFE VALUATION MODEL PQ has 1 million shares outstanding. Its projected FCFE for next year is $30 million, its required return on equity is 13% and perpetual growth rate of FCFE is 5.5%. Find the intrinsic value of the company's share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts