Question: I double-checked the question, here's all condition the question offered. Perhaps there are some other solutions. Thanks to anyone who can help! Analysts expect Blitz

I double-checked the question, here's all condition the question offered. Perhaps there are some other solutions. Thanks to anyone who can help!

I double-checked the question, here's all condition the question offered. Perhaps there are some other solutions. Thanks to anyone who can help!

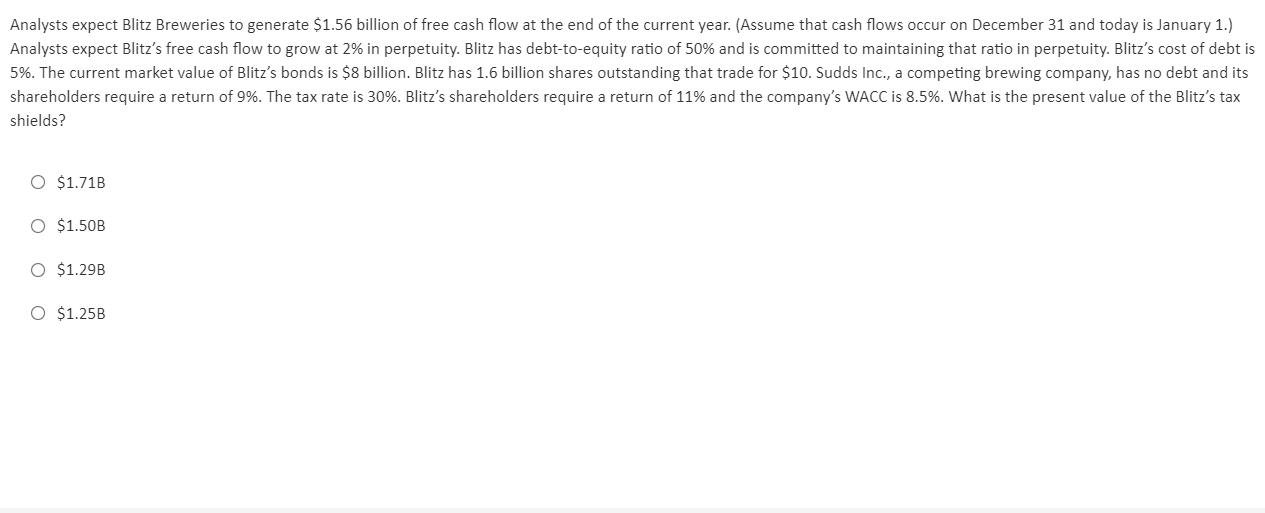

Analysts expect Blitz Breweries to generate $1.56 billion of free cash flow at the end of the current year. (Assume that cash flows occur on December 31 and today is January 1.) Analysts expect Blitz's free cash flow to grow at 2% in perpetuity. Blitz has debt-to-equity ratio of 50% and is committed to maintaining that ratio in perpetuity. Blitz's cost of debt is 5%. The current market value of Blitz's bonds is $8 billion. Blitz has 1.6 billion shares outstanding that trade for $10. Sudds Inc., a competing brewing company, has no debt and its shareholders require a return of 9%. The tax rate is 30%. Blitz's shareholders require a return of 11% and the company's WACC is 8.5%. What is the present value of the Blitz's tax shields? O $1.71B O $1.50B O $1.29B O $1.25B Analysts expect Blitz Breweries to generate $1.56 billion of free cash flow at the end of the current year. (Assume that cash flows occur on December 31 and today is January 1.) Analysts expect Blitz's free cash flow to grow at 2% in perpetuity. Blitz has debt-to-equity ratio of 50% and is committed to maintaining that ratio in perpetuity. Blitz's cost of debt is 5%. The current market value of Blitz's bonds is $8 billion. Blitz has 1.6 billion shares outstanding that trade for $10. Sudds Inc., a competing brewing company, has no debt and its shareholders require a return of 9%. The tax rate is 30%. Blitz's shareholders require a return of 11% and the company's WACC is 8.5%. What is the present value of the Blitz's tax shields? O $1.71B O $1.50B O $1.29B O $1.25B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts