Question: I est fl A eet provided. Work on this page will not be graded. You may use your calculator and the attached Present/Future Value Tables.

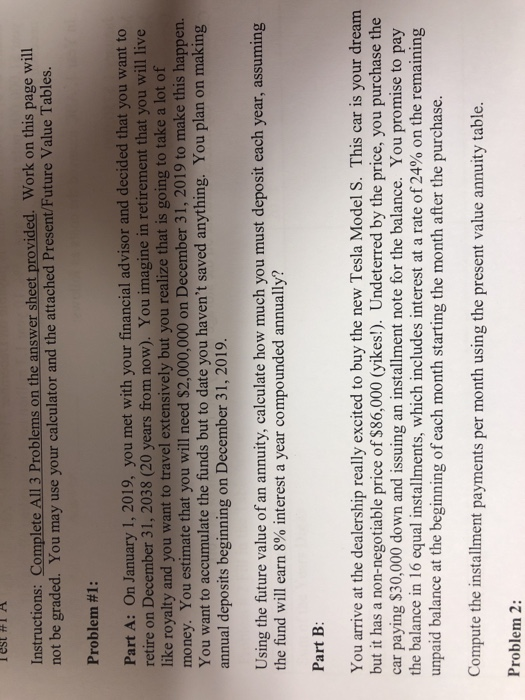

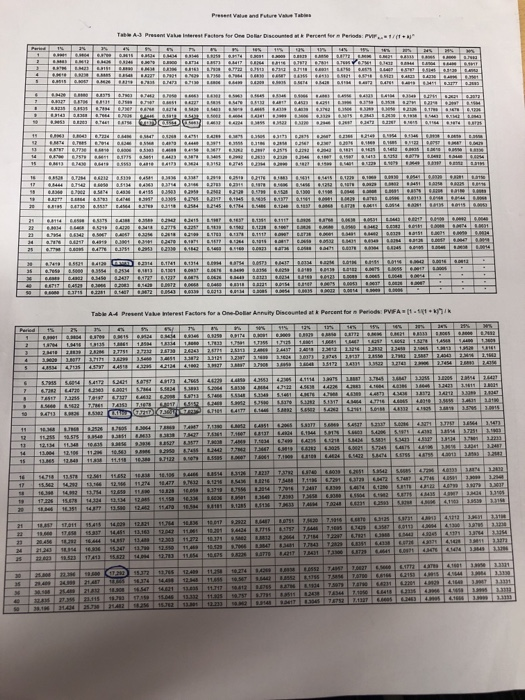

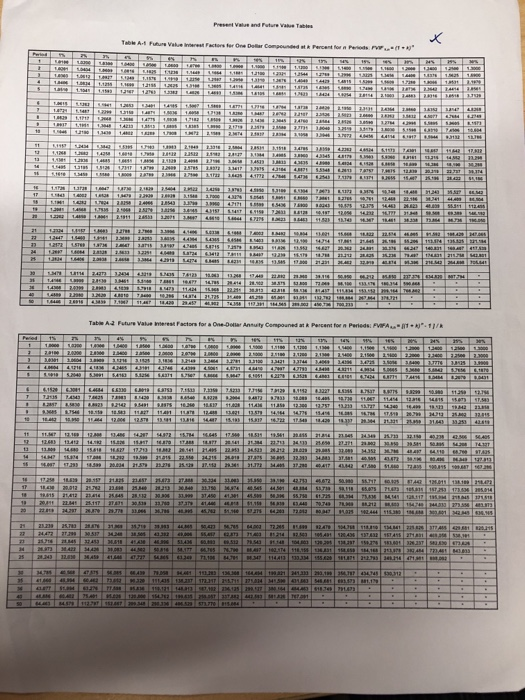

I est fl A eet provided. Work on this page will not be graded. You may use your calculator and the attached Present/Future Value Tables. Problem #1: Part A: On January 1, 2019, you met with your financial advisor and decided that you want to retire on December 31, 2038 (20 years from now). You imagine in retirement that you will live like royalty and you want to travel extensively but you realize that is going to take a lot of money. You estimate that you will need $2,000,000 on December 31, 2019 to make this happen. You want to accumulate the funds but to date you haven't saved anything. You plan on making annual deposits beginning on December 31, 2019. Using the future value of an annuity, calculate how much you must deposit each year, assuming the fund will earn 8% interest a year compounded annually? Part B: You arrive at the dealership really excited to buy the new Tesla Model S. This car is your dream but it has a non-negotiable price of $86,000 (yikes!). Undeterred by the price, you purchase the car paying $30,000 down and issuing an installment note for the balance. You promise to pay the balance in 16 equal installments, which includes interest at a rate of 24% on the remaining unpaid balance at the beginning of each month starting the month after the purchase. Compute the installment payments per month using the present value annuity table. Problem 2: PVF .se1 . kn Prod. k Present Value merest Factors fo, a omoeur Anwny Discounted at k Percent for Table A4 Value Tabies

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts