Question: I estimate a multiple linear regression model for portfolio using market size and value and adding as usual a constant to make sure that E(errors)=0

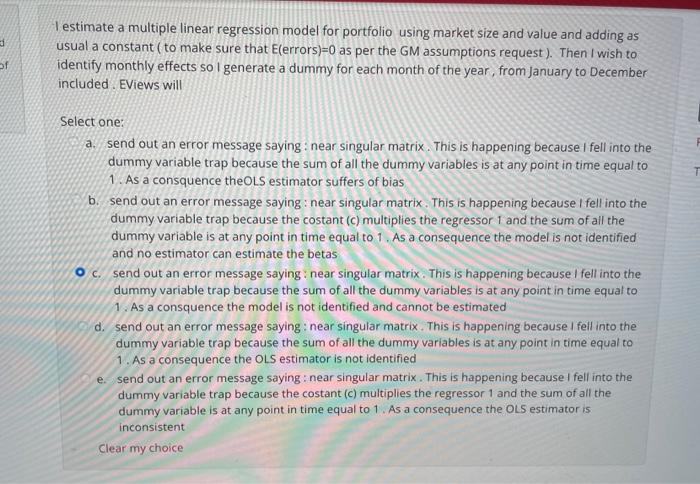

I estimate a multiple linear regression model for portfolio using market size and value and adding as usual a constant to make sure that E(errors)=0 as per the GM assumptions request ). Then I wish to identify monthly effects so i generate a dummy for each month of the year, from January to December included. EViews will f Select one: a. send out an error message saying: near singular matrix. This is happening because I fell into the dummy variable trap because the sum of all the dummy variables is at any point in time equal to 1. As a consquence theOLS estimator suffers of bias b. send out an error message saying near singular matrix. This is happening because I fell into the dummy variable trap because the costant (c) multiplies the regressor 1 and the sum of all the dummy variable is at any point in time equal to 1. As a consequence the model is not identified and no estimator can estimate the betas O c. send out an error message saying: near singular matrix. This is happening because I fell into the dummy variable trap because the sum of all the dummy variables is at any point in time equal to 1. As a consquence the model is not identified and cannot be estimated d. send out an error message saying: near singular matrix. This is happening because I fell into the dummy variable trap because the sum of all the dummy variables is at any point in time equal to 1. As a consequence the OLS estimator is not identified e send out an error message saying: near singular matrix. This is happening because I fell into the dummy variable trap because the costant (c) multiplies the regressor 1 and the sum of all the dummy variable is at any point in time equal to 1. As a consequence the OLS estimator is inconsistent Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts