Question: (i) Evaluate the acceptability of the three projects based on NPV, PI, IRR and indicate which project you would recommend. Explain why you propose the

(i) Evaluate the acceptability of the three projects based on NPV, PI, IRR and indicate which project you would recommend. Explain why you propose the selected project(s). (ii) Briefly explain the concept of the time value of money in the capital budgeting technique.

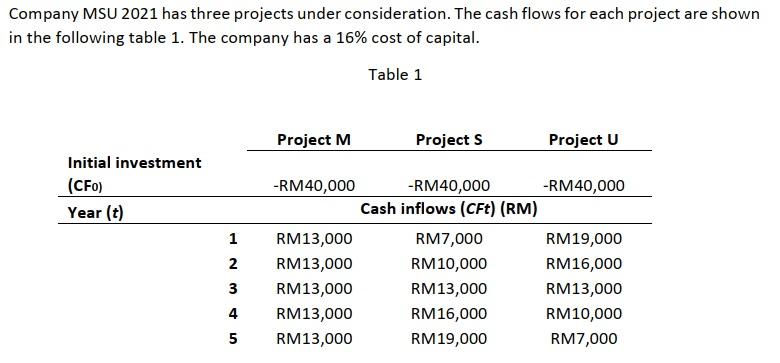

Company MSU 2021 has three projects under consideration. The cash flows for each project are shown in the following table 1. The company has a 16% cost of capital. Table 1 Project M Projects Project U Initial investment (CFO) Year (t) 1 1 2 -RM40,000 -RM40,000 -RM40,000 Cash inflows (CFt) (RM) RM13,000 RM7,000 RM19,000 RM13,000 RM10,000 RM16,000 RM13,000 RM13,000 RM13,000 RM13,000 RM16,000 RM10,000 RM13,000 RM19,000 RM7,000 3 4 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts