Question: (i) Explain whether or not the discount rate used by the firm in its NPV calculations is needed when employing the Internal Rate of

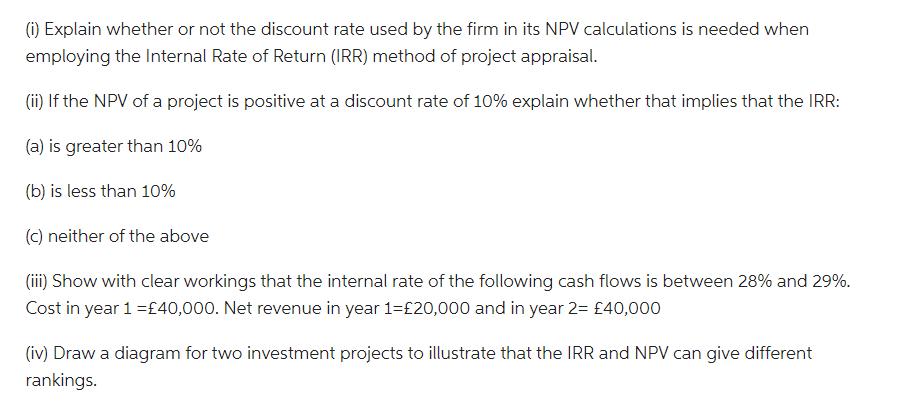

(i) Explain whether or not the discount rate used by the firm in its NPV calculations is needed when employing the Internal Rate of Return (IRR) method of project appraisal. (ii) If the NPV of a project is positive at a discount rate of 10% explain whether that implies that the IRR: (a) is greater than 10% (b) is less than 10% (c) neither of the above (iii) Show with clear workings that the internal rate of the following cash flows is between 28% and 29%. Cost in year 1 = 40,000. Net revenue in year 1-20,000 and in year 2= 40,000 (iv) Draw a diagram for two investment projects to illustrate that the IRR and NPV can give different rankings.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

i The discount rate used by the firm in its NPV calculations is not needed when employing the Internal Rate of Return IRR method of project appraisal ... View full answer

Get step-by-step solutions from verified subject matter experts