Question: i failed this quiz, please help me understand what I did wrong. On 1/1X1, P Company acquired 10% of Company for $10,000 and began using

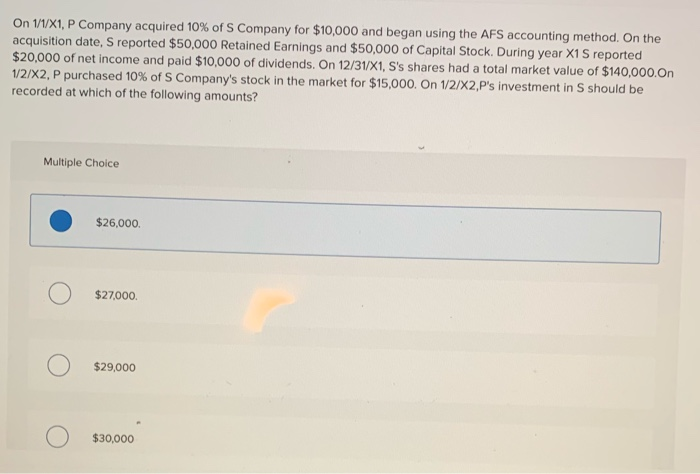

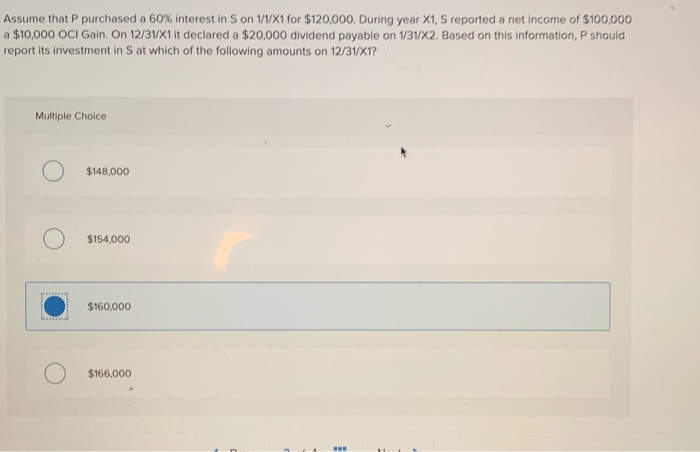

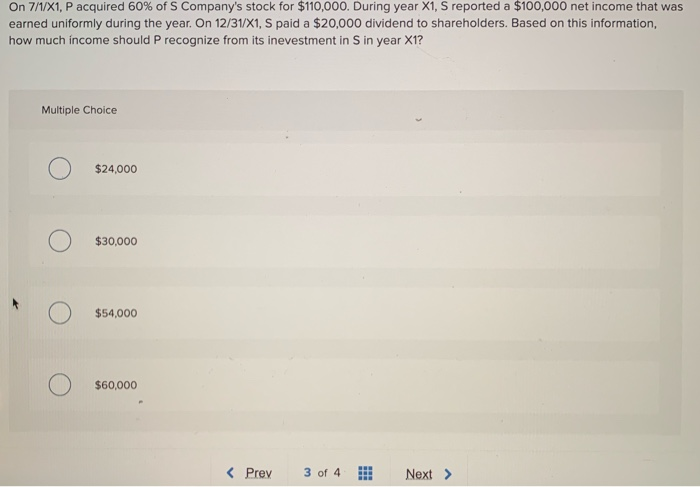

On 1/1X1, P Company acquired 10% of Company for $10,000 and began using the AFS accounting method. On the acquisition date, S reported $50,000 Retained Earnings and $50,000 of Capital Stock. During year X1S reported $20,000 of net income and paid $10,000 of dividends. On 12/31/X1, S's shares had a total market value of $140,000.On 1/2/X2, P purchased 10% of Company's stock in the market for $15,000. On 1/2/X2,P's investment in S should be recorded at which of the following amounts? Multiple Choice $26.000 $27,000 $29,000 $30,000 Assume that P purchased a 60% interest in Son 1/1/X1 for $120,000. During year X1, S reported a net income of $100,000 a $10,000 OCI Gain. On 12/31/X1 it declared a $20,000 dividend payable on 1/31/X2. Based on this information, P should report its investment in S at which of the following amounts on 12/31/X1? Multiple Choice $148,000 $154,000 $160,000 $166,000 BE On 7/1/X1, P acquired 60% of s Company's stock for $110,000. During year X1, S reported a $100,000 net income that was earned uniformly during the year. On 12/31/X1, S paid a $20,000 dividend to shareholders. Based on this information, how much income should P recognize from its inevestment in Sin year X1? Multiple Choice $24,000 $30,000 $54,000 $60,000 3 of 4 H.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts