Question: I feel as though the question is too vague when it describes the processes to know if theyre FIFO LIFO or average cost The Comfort

I feel as though the question is too vague when it describes the processes to know if theyre FIFO LIFO or average cost

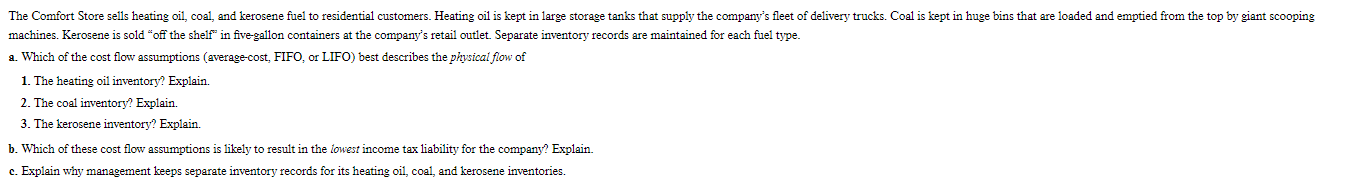

The Comfort Store sells heating oil, coal, and kerosene fuel to residential customers. Heating oil is kept in large storage tanks that supply the companys fleet of delivery trucks. Coal is kept in huge bins that are loaded and emptied from the top by giant scooping machines. Kerosene is sold "off the shelf" in fivegallon containers at the company's retail outlet. Separate inventory records are maintained for each fuel type.

a Which of the cost flow assumptions averagecost FIFO, or LIFO best describes the physical flow of

The heating oil inventory? Explain.

The coal inventory? Explain.

The kerosene inventory? Explain.

b Which of these cost flow assumptions is likely to result in the lowest income tax liability for the company? Explain.

c Explain why management keeps separate inventory records for its heating oil, coal, and kerosene inventories.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock