Question: I feel that I did wrong on part (a) calculation. please solve the correct method for sub question (a)(b)(c)(d) thank you Tour Question 2 First

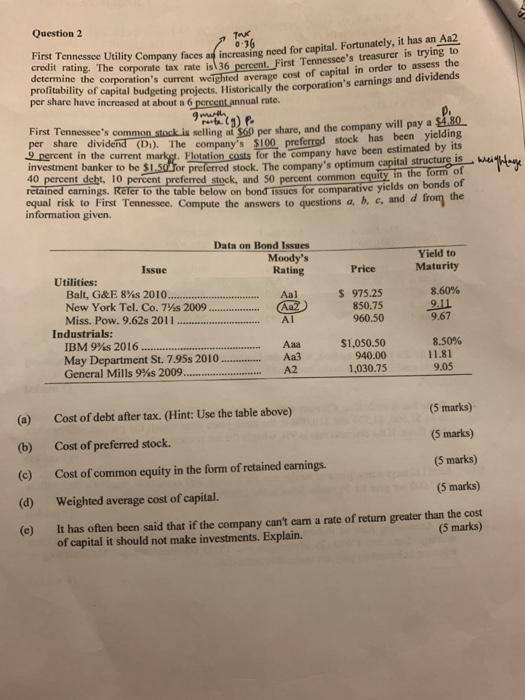

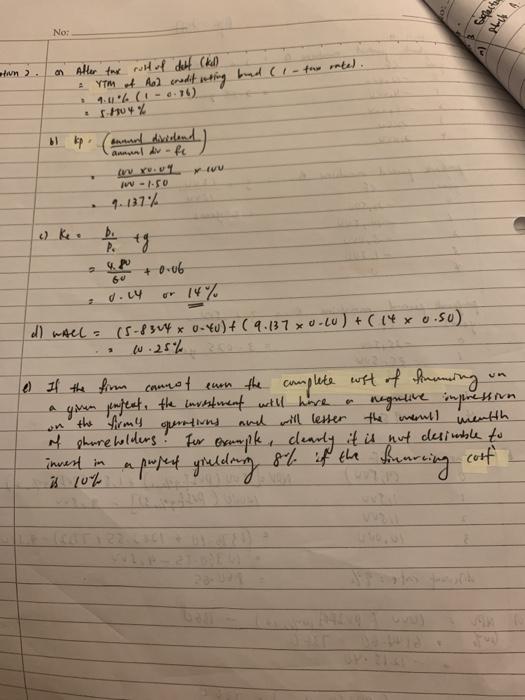

Tour Question 2 First Tennessee Utility Company faces and increasing need for capital. Fortunately, it has an A12 profitability of capital budgeting projects. Historically the corporation's carnings and dividends determine the corporation's current weighted average cost of capital in order to assess the per share have increased at about a 6 percent annual rate. with First Tennessee's common stock is telling ? per share, and the company will pay a 180 per share dividend (D). The company's S100 preferred stock has been yielding investment banker to be $1 soffor preferred stock. The company's optimum capital structurg 9 percent in the current market. Flotation costs for the company have been estimated by its 40 percent debt, 10 percent preferred stock, and 50 percent common equity in the form of retained earnings. Refer to the table below on bond issues for comparative yields on bonds of equal risk to First Tennessee. Compute the answers to questions a, b, c, and d from the information given. is weightage Yield to Maturity Price Data on Bond Issues Moody's Issue Rating Utilities: Balt, G&E 8%s 2010 Aal New York Tel. Co. 7%s 2009 Aal Miss. Pow. 9.62s 2011 Industrials: IBM 9%s 2016 Aaa May Department St. 7.95s 2010 Aa3 General Mills 9%s 2009. A2 $ 975.25 850.75 960.50 8.60% 9.11 9.67 $1.050.50 940.00 1,030.75 8.50% 11.81 9.05 (a) (b) Cost of debt after tax. (Hint: Use the table above) (5 marks) Cost of preferred stock. (5 marks) Cost of common equity in the form of retained earnings. (5 marks) Weighted average cost of capital. (5 marks) It has often been said that if the company can't cum a rate of return greater than the cost of capital it should not make investments. Explain. (5 marks) (d) No: en ). on After tax with of det (kl) rim of And anodit using band ( 1 - tow rated. 1.0.6 (1-1) TH 1 annand dividend annual arfe wu. vu -1.50 9. 137% D. + 0.06 60 d.uy dl wall = (5-8314 0-40)+(9.137 x 0.20 ) + ( 14 x 0.so) 0.25% a If the firm cannot earn the complete wit of fanning ayoran pemfect, the investment will have a negative impression on the firmy operations and will lesser the mould menth of phareholders for example, clearly it is not desimble to aposed grundeng 8t if the kaaring cost invest in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts