Question: I figured out problem 9 and 10 but I am still having trouble with problem 6,7 and 8. Thank you A Six-year, 8% (annual) bond

I figured out problem 9 and 10 but I am still having trouble with problem 6,7 and 8. Thank you

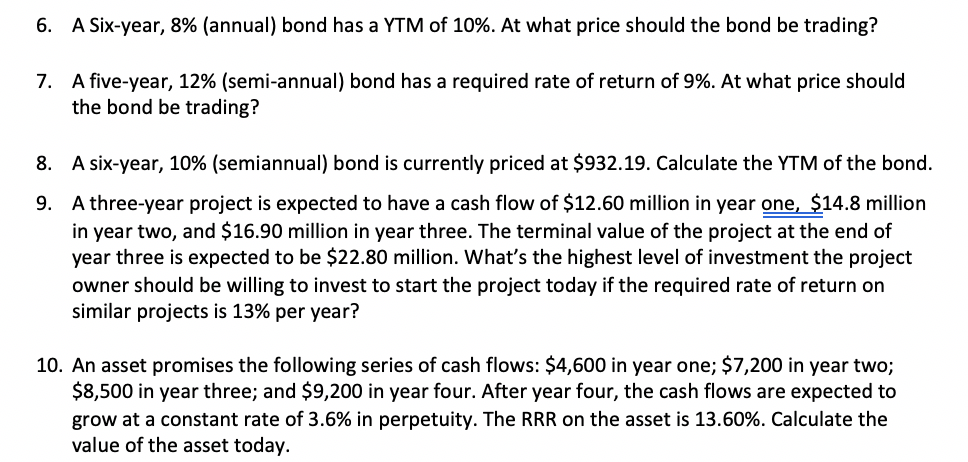

A Six-year, 8% (annual) bond has a YTM of 10%. At what price should the bond be trading? 6. A five-year, 12% (semi-annual) bond has a the bond be trading? required rate of return of 9%. At what price should 7. A six-year, 10% (semiannual) bond is currently priced at $932.19. Calculate the YTM of the bond. 8. A three-year project is expected to have a cash flow of $12.60 million in year one, $14.8 million in year two, and $16.90 million in year three. The terminal value of the project at the end of year three is expected to be $22.80 million. What's the highest level of investment the project 9. owner should be willing to invest to start the project today if the required rate of return on similar projects is 13% per year? 10. An asset promises the following series of cash flows: $4,600 in year one; $7,200 in year two; $8,500 in year three; and $9,200 in year four. After year four, the cash flows are expected to grow at a constant rate of 3.6% in perpetuity. The RRR on the asset is 13.60%. Calculate the value of the asset today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts