Question: I find this question a little confusing, Im studying some practice finance questions. Please assist with some guidance how to solve At the end of

I find this question a little confusing, Im studying some practice finance questions. Please assist with some guidance how to solve

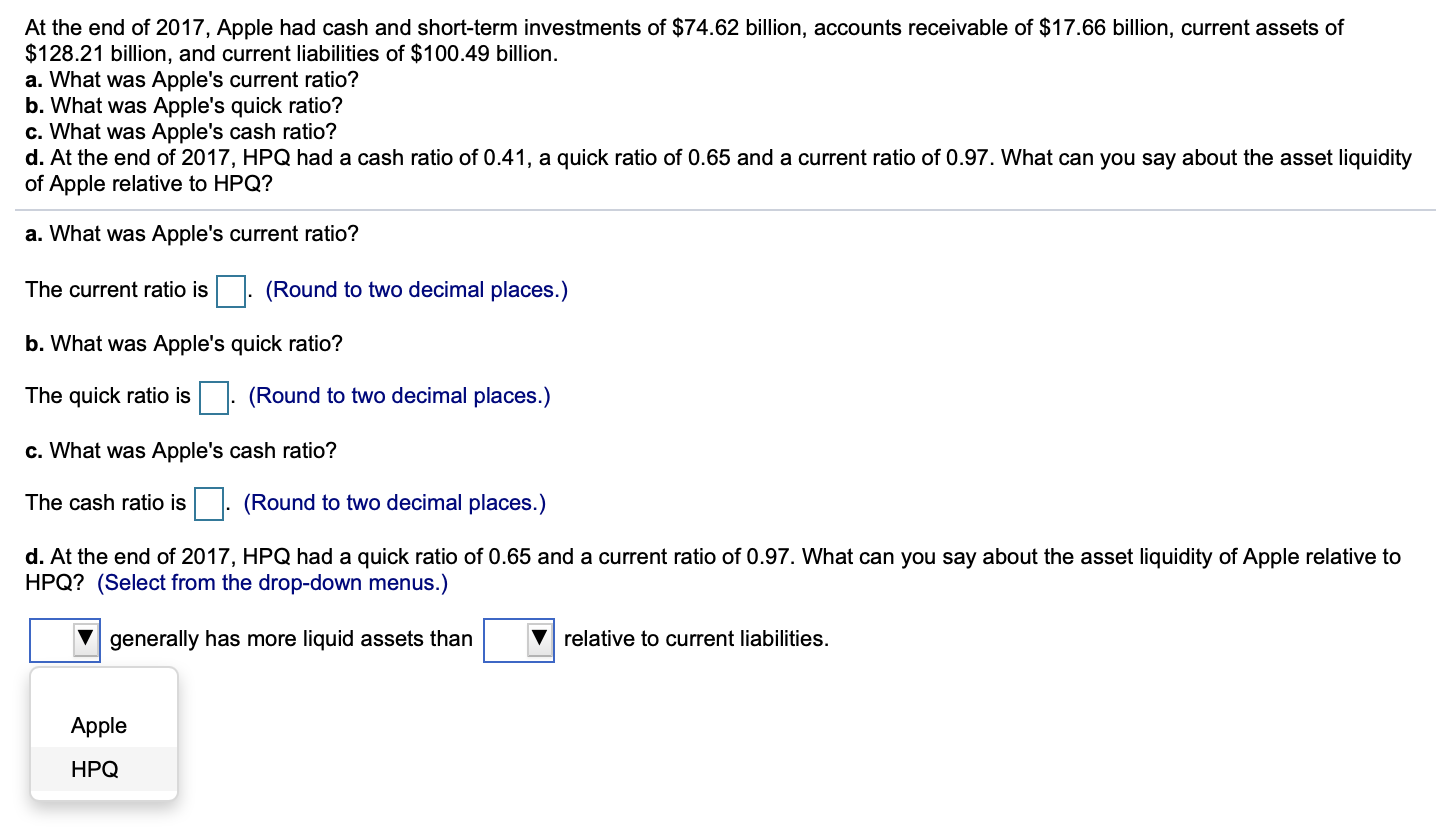

At the end of 2017, Apple had cash and short-term investments of $74.62 billion. accounts receivable of $17.66 billion. current assets of $128.21 billion, and current liabilities of $100.49 billion. a. What was Apple's current ratio? b. What was Apple's quick ratio? c. What was Apple's cash ratio? d. At the end of 2017, HPQ had a cash ratio of 0.41, a quick ratio of 0.65 and a current ratio of 0.97. What can you say about the asset liquidity of Apple relative to HPQ? a. What was Apple's current ratio? The current ratio is D. (Round to two decimal places.) b. What was Apple's quick ratio? The quick ratio is D. {Round to two decimal places.) c. What was Apple's cash ratio? The cash ratio is D. (Round to two decimal places.) d. At the end of 2017, HPQ had a quick ratio of 0.65 and a current ratio of 0.97. What can you say about the asset liquidity of Apple relative to HPQ? (Select from the drop-down menus.) El generally has more liquid assets than El relative to current liabilities. Apple HP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts