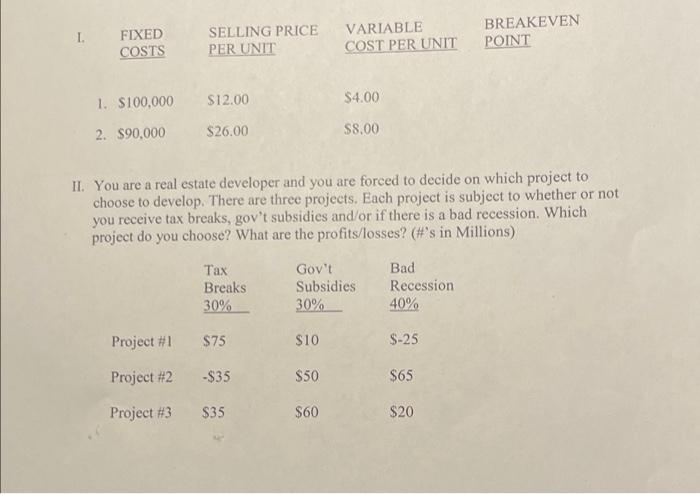

Question: I. FIXED COSTS SELLING PRICE PER UNIT VARIABLE COST PER UNIT BREAKEVEN POINT 1. $100,000 $12.00 $4.00 2. $90,000 $26.00 $8.00 II. You are a

I. FIXED COSTS SELLING PRICE PER UNIT VARIABLE COST PER UNIT BREAKEVEN POINT 1. $100,000 $12.00 $4.00 2. $90,000 $26.00 $8.00 II. You are a real estate developer and you are forced to decide on which project to choose to develop. There are three projects. Each project is subject to whether or not you receive tax breaks, gov't subsidies and/or if there is a bad recession. Which project do you choose? What are the profits/losses? (#'s in Millions) Tax Breaks 30% Gov't Subsidies 30% Bad Recession 40% Project #1 $75 $10 S-25 Project #2 -$35 $50 $65 Project #3 $35 $60 $20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts