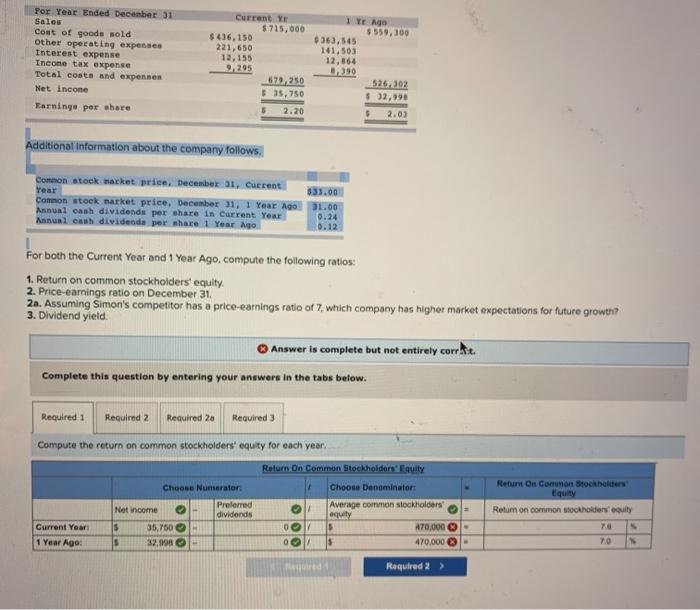

Question: i forgot to add my issue. I only need help with this one problem I first thought it was 162500. but that didn't work so

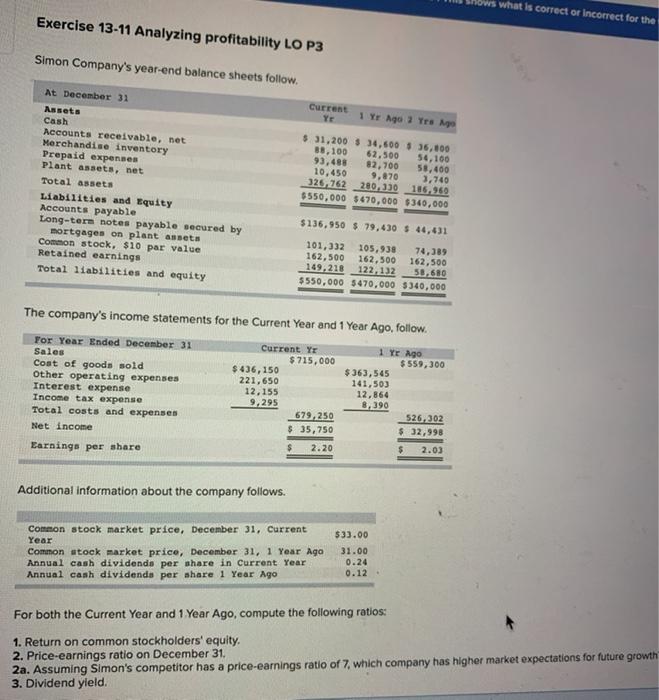

ws what is correct or incorrect for the Exercise 13-11 Analyzing profitability LO P3 Simon Company's year-end balance sheets follow. Current Ye 1 Yr Ago 2 Tre Mo At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 31,200 $ 34,500 $ 36,000 88,100 62,500 56,100 93,488 82,700 58,400 10,450 9,870 3,740 325 762 280.330 116.969 $550,000 $470,000 $340,000 $136,950 $ 79,430 $ 44,431 101,332 105,938 74,389 162,500 162.500 162,500 149.218 122,132 58.610 $550,000 $470,000 $340,000 The company's income statements for the Current Year and 1 Year Ago, follow. For Year Ended December 31 Sales Cost of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net Income Earnings per share Current Yr $715,000 $ 436,150 221,650 12.155 9,295 679,250 $ 35,750 $ 2.20 1 Yr Ago $559,300 $363,545 141,503 12,864 8,390 526,2302 $32,998 $ 2.03 Additional information about the company follows. $33.00 Common stock market price, December 31, Current Year Common stock market price, December 31, 1 Year Ago Annual cash dividende per share in Current Year Annual cash dividenda per share 1 Year Ago 31.00 0.24 0.12 For both the Current Year and 1 Year Ago, compute the following ratios: 1. Return on common stockholders' equity. 2. Price-earnings ratio on December 31 2a. Assuming Simon's competitor has a price-earnings ratio of 7, which company has higher market expectations for future growth 3. Dividend yield For Year Ended December 31 Sales Coat of goods sold Other operating expenses Interest expense Income tax expense Total costs and expenses Net income Earninge per share Current Ye $715,000 $436,150 221,650 12,155 1 Yr Ago $559,300 $363,345 141,503 12,864 525, 302 672,250 $ 35,750 5 2.20 $ 2.03 Additional information about the company follows Common stock market price, December 31, Current Year $33.00 Common stock market price, December 31, 1 Year Ago 31.00 Annual cash dividends per share in Current Year 0.24 Annual cash dividenda per share 1 Year o 0.12 For both the Current Year and 1 Year Ago.compute the following ratlos: 1. Return on common stockholders' equity. 2. Price earnings ratio on December 31, 20. Assuming Simon's competitor has a price earnings ratio of 7, which company has higher market expectations for future growth? 3. Dividend yield Answer is complete but not entirely corrAt. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 2 Required Compute the return on common stockholders' equity for each year. Return On Common Stockholders' Equity Choose Numerator Preferred - Net income dividends IS 35,750 S 32.998 - Choose Denominator Average common stockholders equity S 470,000 - 470.000 - Return On Common Stockholders Equity Return on common stockholders equity Current Year 1 Year Ago: 0 70 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts