Question: I found the answer for #2 to be $2,981.93, but I need help with #3. 2 You have inherited $25,000 and wish to purchase an

I found the answer for #2 to be $2,981.93, but I need help with #3.

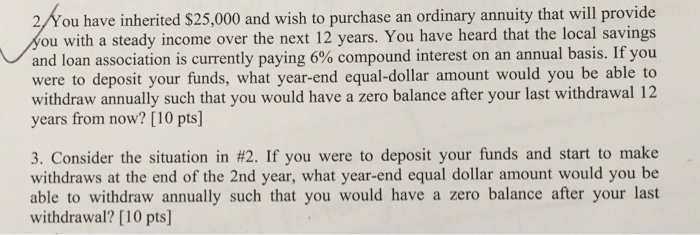

I found the answer for #2 to be $2,981.93, but I need help with #3. 2 You have inherited $25,000 and wish to purchase an ordinary annuity that will provide ou with a steady income over the next 12 years. You have heard that the local savings and loan association is currently paying 6% compound interest on an annual basis. If you were to deposit your funds, what year-end equal-dollar amount would you be able to withdraw annually such that you would have a zero balance after your last withdrawal 12 years from now? [10 pts] 3. Consider the situation in #2. If you were to deposit your funds and start to make withdraws at the end of the 2nd year, what year-end equal dollar amount would you be able to withdraw annually such that you would have a zero balance after your last withdrawal? [10 pts]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts