Question: I got 11 , 5 and 6 wrong please help me to fix it :: 5- Taking advantage of ASCI's educational assistance program, during the

I got 11 , 5 and 6 wrong please help me to fix it ::

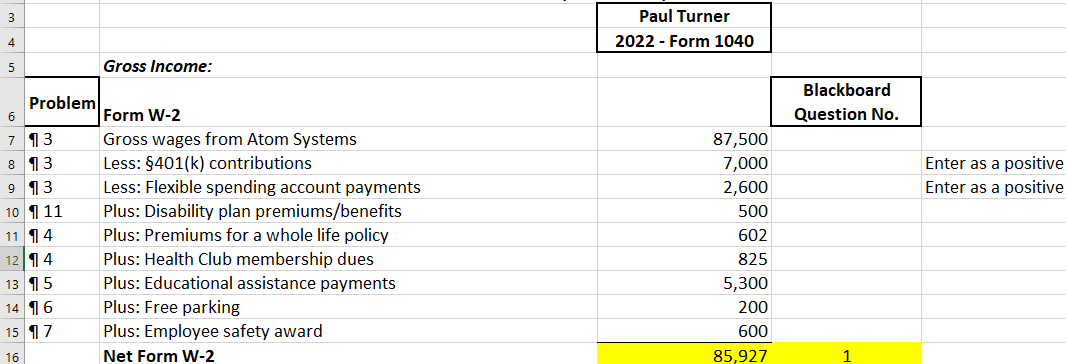

5- Taking advantage of ASCI's educational assistance program, during the fall Paul enrolled in two graduate engineering classes at a local college. ASCI paid his tuition, fees, and other course-related costs of $5,300.

6- Paul received free parking in the company's security garage that would normally cost $200 per month.

11- Paul slipped on a wet spot in front of a computer store last July. He broke his ankle and was unable to work for two weeks. He incurred $1,300 in medical costs, all of which were paid by the owner of the store. The store also gave him $1,000 for pain and suffering resulting from the injury. ASCI did not pay his salary during the two weeks he missed because of the accident. However, ASCI's disability insurance plan paid him $1,500 in disability pay for the time he was unable to work. Under this plan, ASCI pays the premiums of $500 for the disability insurance as a taxable fringe benefit. The disability plan premiums and the disability benefit payments were not included in Pauls W-2 wages reported in paragraph 3.

i got only 5.6 and 11 wrong

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts