Question: I got 3,000 contracts needed for part A. need help with parts b. through d. please and thank you!! 13*. [4 Points) Your bond portfolio

I got 3,000 contracts needed for part A. need help with parts b. through d. please and thank you!!

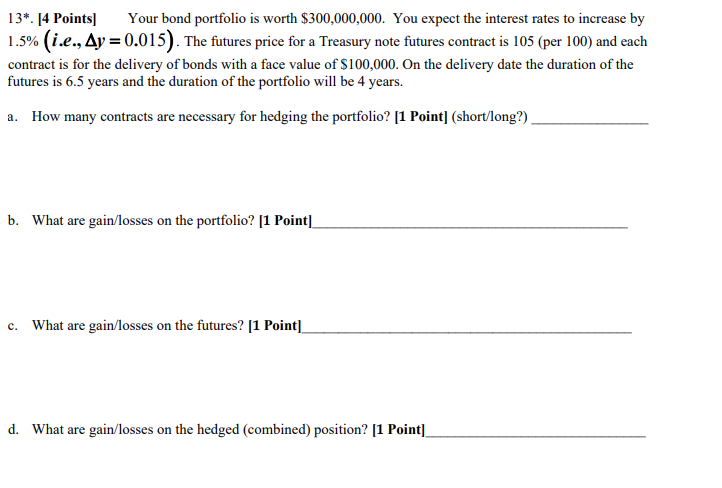

13*. [4 Points) Your bond portfolio is worth $300,000,000. You expect the interest rates to increase by 1.5% (i.e., Ay = 0.015). The futures price for a Treasury note futures contract is 105 (per 100) and each contract is for the delivery of bonds with a face value of $100,000. On the delivery date the duration of the futures is 6.5 years and the duration of the portfolio will be 4 years. a. How many contracts are necessary for hedging the portfolio? [1 Point] (short/long?). b. What are gain/losses on the portfolio? [1 Point) C. What are gain/losses on the futures? [1 Point) d. What are gain/losses on the hedged (combined) position? [1 Point] 13*. [4 Points) Your bond portfolio is worth $300,000,000. You expect the interest rates to increase by 1.5% (i.e., Ay = 0.015). The futures price for a Treasury note futures contract is 105 (per 100) and each contract is for the delivery of bonds with a face value of $100,000. On the delivery date the duration of the futures is 6.5 years and the duration of the portfolio will be 4 years. a. How many contracts are necessary for hedging the portfolio? [1 Point] (short/long?). b. What are gain/losses on the portfolio? [1 Point) C. What are gain/losses on the futures? [1 Point) d. What are gain/losses on the hedged (combined) position? [1 Point]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts