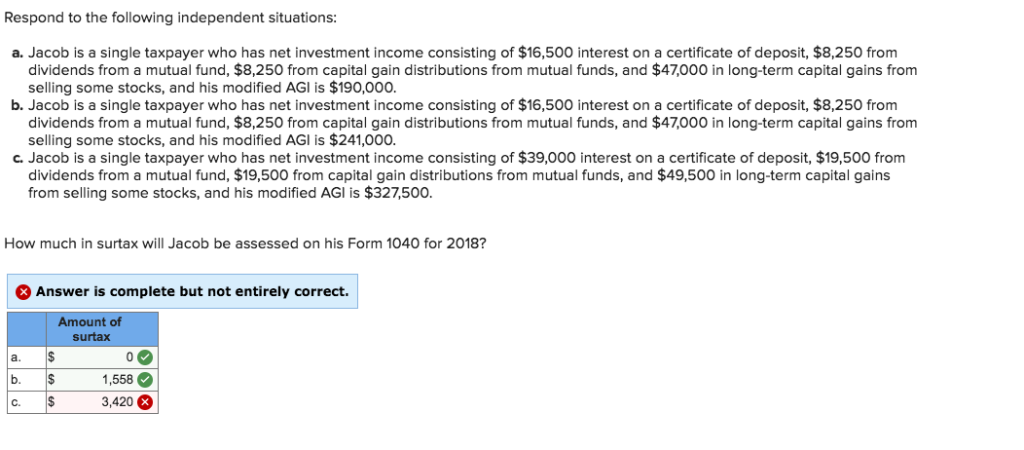

Question: I got 3420 answer but its showing me wrong.. Respond to the following independent situations a. Jacob is a single taxpayer who has net investment

I got 3420 answer but its showing me wrong..

I got 3420 answer but its showing me wrong..

Respond to the following independent situations a. Jacob is a single taxpayer who has net investment income consisting of $16,500 interest on a certificate of deposit, $8,250 from dividends from a mutual fund, $8,250 from capital gain distributions from mutual funds, and $47,000 in long-term capital gains from selling some stocks, and his modified AGI is $190,000. b. Jacob is a single taxpayer who has net investment income consisting of $16,500 interest on a certificate of deposit, $8,250 from dividends from a mutual fund, $8,250 from capital gain distributions from mutual funds, and $47,000 in long-term capital gains from selling some stocks, and his modified AGI is $241,000. c. Jacob is a single taxpayer who has net investment income consisting of $39,000 interest on a certificate of deposit, $19,500 from dividends from a mutual fund, $19,500 from capital gain distributions from mutual funds, and $49,500 in long-term capital gains from selling some stocks, and his modified AGI is $327,500. How much in surtax will Jacob be assessed on his Form 1040 for 2018 Answer is complete but not entirely correct. Amount of surtax a. 1,558 3,420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts