Question: I got 5 errors I don't know where 47.0/ 52.0 Points Question 2 of 3 Company estimates that 240000 direct labour hours will be worked

I got 5 errors I don't know where

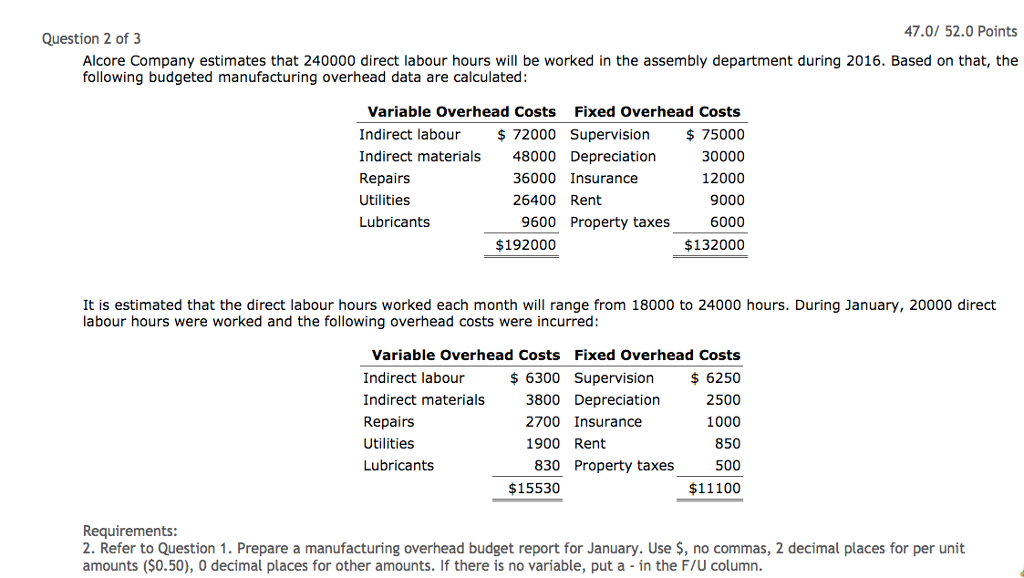

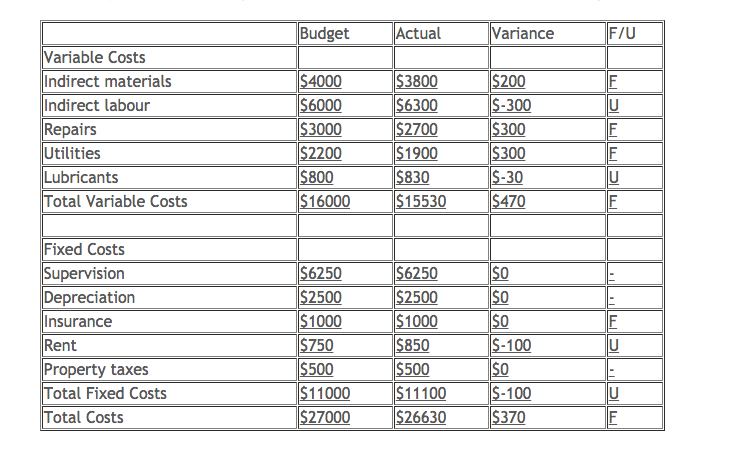

47.0/ 52.0 Points Question 2 of 3 Company estimates that 240000 direct labour hours will be worked in the assembly department during 2016. Based on that, the following budgeted manufacturing overhead data are calculated: Variable Overhead Costs Fixed Overhead Costs Indirect labour 72000 Supervision 75000 Indirect materials 48000 Depreciation 30000 36000 Insurance 12000 Repairs 26400 Rent 9000 Utilities 9600 Property taxes Lubricants 6000 $132000 $192000 It is estimated that the direct labour hours worked each month will range from 18000 to 24000 hours. During January, 20000 direct labour hours were worked and the following overhead costs were incurred: Variable Overhead Costs Fixed Overhead Costs In labour 6300 Supervision 6250 2500 Indirect materials 3800 Depreciation Repairs 2700 Insurance 1000 Utilities 1900 Rent 850 Lubricants 830 Property taxes 500 $15530 $11100 Requirements: 2. Refer to Question 1. Prepare a manufacturing overhead budget report for January. Use no commas, 2 decimal places for per unit amounts ($0.50), 0 decimal places for other amounts. If there is no variable, put a in the F/U column

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts