Question: I got a like if finished by tonight! Comprehensive Problem Peoria Trading Company is a retail business that uses the perpetual inventory system and the

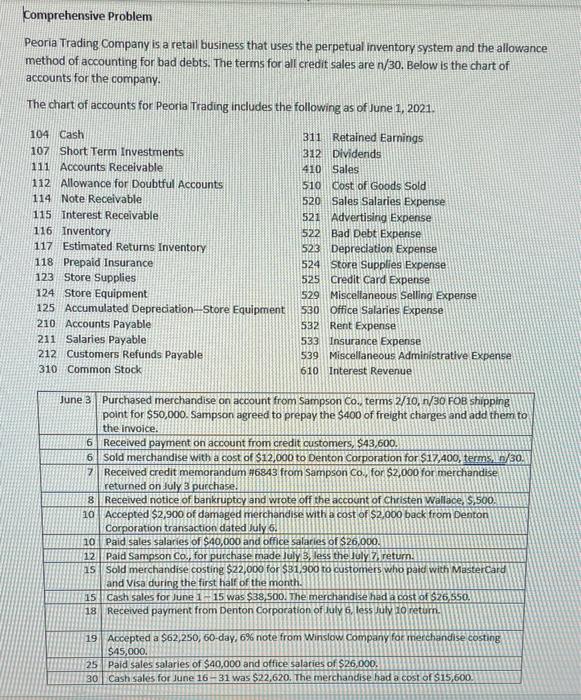

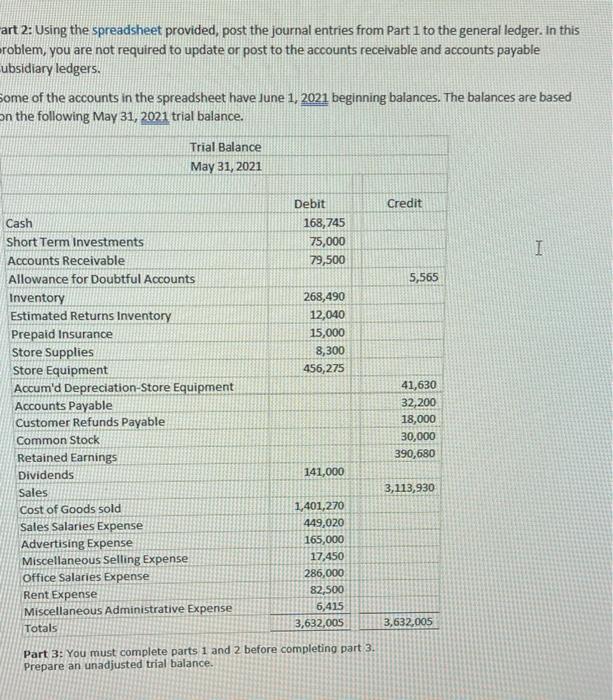

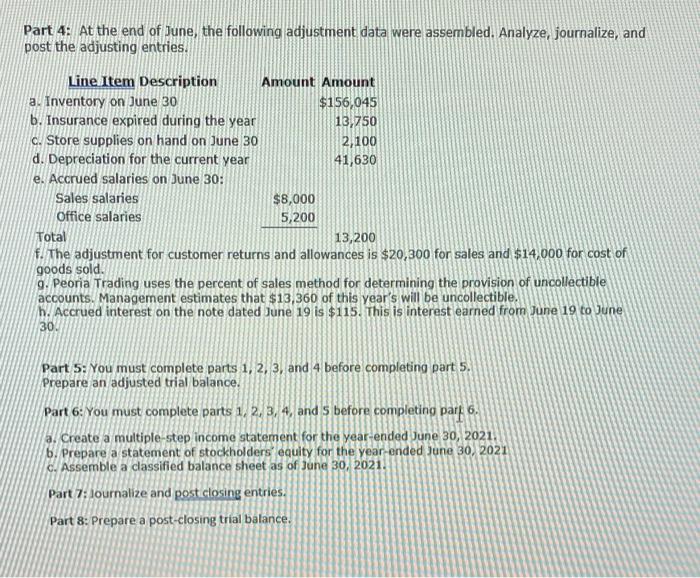

Comprehensive Problem Peoria Trading Company is a retail business that uses the perpetual inventory system and the allowance method of accounting for bad debts. The terms for all credit sales are n/30. Below is the chart of accounts for the company. The chart of accounts for Peoria Trading includes the following as of June 1, 2021. 104 Cash 107 Short Term Investments 111 Accounts Receivable 112 Allowance for Doubtful Accounts 114 Note Receivable 115 Interest Receivable 116 Inventory 117 Estimated Returns Inventory 118 Prepaid Insurance 123 Store Supplies 124 Store Equipment 125 Accumulated Depreciation-Store Equipment 210 Accounts Payable 211 Salaries Payable 212 Customers Refunds Payable 310 Common Stock 311 Retained Earnings 312 Dividends 410 Sales 510 Cost of Goods Sold 520 Sales Salaries Expense 521 Advertising Expense 522 Bad Debt Expense 523 Depreciation Expense 524 Store Supplies Expense 525 Credit Card Expense 529 Miscellaneous Selling Expense 530 Office Salaries Expense 532 Rent Expense 533 Insurance Expense 539 Miscellaneous Administrative Expense 610 Interest Revenue June 3 Purchased merchandise on account from Sampson Co., terms 2/10, 1/30 FOB shipping point for $50,000. Sampson agreed to prepay the $400 of freight charges and add them to the invoice. 6. Received payment on account from credit customers, $43,600. 6 Sold merchandise with a cost of $12,000 to Denton Corporation for $17400, terms/30. 7 Received credit memorandum #6843 from Sampson Co., for $2,000 for merchandise returned on July 3 purchase. 8 Received notice of bankruptcy and wrote off the account of Christen Wallace, $,500. 10 Accepted $2,900 of damaged merchandise with a cost of $2,000 back from Denton Corporation transaction dated July 6. 10 Paid sales salaries of $40,000 and office salaries of $26,000. 12 Paid Sampson Co., for purchase made July 3, less the July return. 15 Sold merchandise costing $22,000 for $81,900 to customers who paid with Mastercard and Visa during the first half of the month. 15 Cash sales for June 1-15 was $38,500. The merchandise had a cost of $26,550. 18 Received payment from Denton Corporation of July 6, less July 10 retum. 19 Accepted a $62,250, 60-day, 6% note from Winslow Company for merchandise costing $45,000. 25 Paid sales salaries of $40,000 and office salaries of $26,000 30 Cash sales for June 16 -31 was $22,620. The merchandise had a cost of $15,600. art 2: Using the spreadsheet provided, post the journal entries from Part 1 to the general ledger. In this roblem, you are not required to update or post to the accounts receivable and accounts payable ubsidiary ledgers. some of the accounts in the spreadsheet have June 1, 2021 beginning balances. The balances are based on the following May 31, 2021 trial balance. Trial Balance May 31, 2021 Credit Debit 168,745 75,000 79,500 I 5,565 268,490 12,040 15,000 8,300 456,275 Cash Short Term Investments Accounts Receivable Allowance for Doubtful Accounts Inventory Estimated Returns Inventory Prepaid Insurance Store Supplies Store Equipment Accum'd Depreciation-Store Equipment Accounts Payable Customer Refunds Payable Common Stock Retained Earnings Dividends Sales Cost of Goods sold Sales Salaries Expense Advertising Expense Miscellaneous Selling Expense Office Salaries Expense Rent Expense Miscellaneous Administrative Expense Totals 41,630 32,200 18,000 30,000 390,680 141,000 3,113,930 1,401,270 449,020 165,000 17,450 286,000 82,500 6,415 3,632,005 3,632,005 Part 3: You must complete parts 1 and 2 before completing part 3. Prepare an unadjusted trial balance. Part 4: At the end of June, the following adjustment data were assembled. Analyze, journalize, and post the adjusting entries. Line Item Description Amount Amount a. Inventory on June 30 $156,045 b. Insurance expired during the year 13,750 C. Store supplies on hand on June 30 2,100 d. Depreciation for the current year 41,630 e. Accrued salaries on June 30: Sales salaries $8,000 Office salaries 5,200 Total 13,200 f. The adjustment for customer returns and allowances is $20,300 for sales and $14,000 for cost of goods sold. 9. Peoria Trading uses the percent of sales method for determining the provision of uncollectible accounts. Management estimates that $13,360 of this year's will be uncollectible. b. Accrued interest on the note dated June 19 is $115. This is interest earned from June 19 to June 30. Part 5: You must complete parts 1, 2, 3, and 4 before completing part 5. Prepare an adjusted trial balance. Part 6: You must complete parts 1, 2, 3, 4, and s before completing part 6. a. Create a multiple-step income statement for the year-ended June 30, 2021. 6. Prepare a statement of stockholders' equity for the year-ended June 30, 2021 C. Assemble a classified balance sheet as of June 30, 2021. Part 7: lournalize and post closing entries. Part 8: Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts